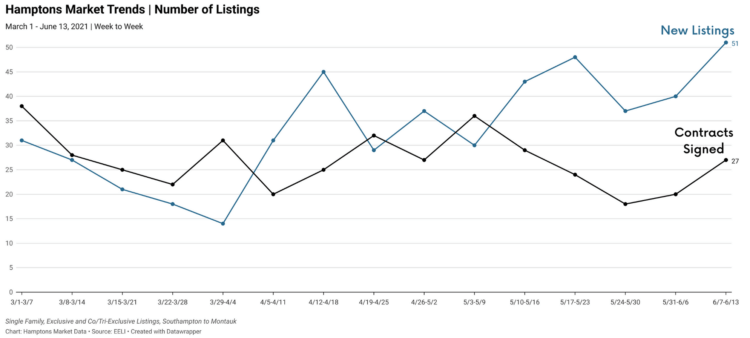

In the month of May, the Hamptons real estate market showed evidence of the clear shift that agents, buyers and sellers began to feel at the beginning of April. New listings ticked up, while contracts signed declined, but didn’t yet reach normal market levels.

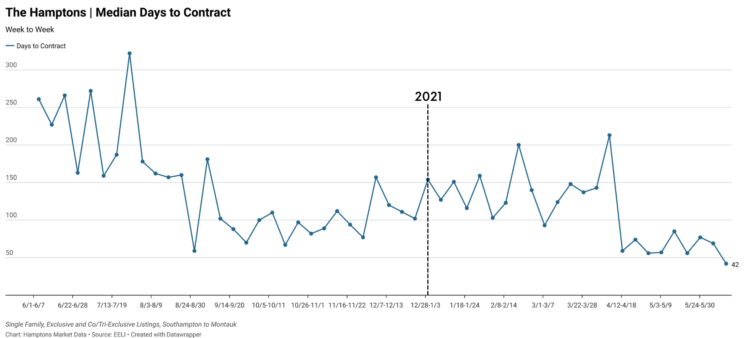

So far in June, contract activity is back on a more rational upward trend, verifying industry professional suspicions that low inventory over the winter and spring prompted pent up buyer demand. This is further evidenced by the lowest weekly number of days to contract in recent Hamptons market history — 42 median days from list to contract for the week of June 7 to 13.

While new market listings now exceed signed contracts, well positioned listings are still being snatched up at an extraordinarily fast pace. Gone, however, are the days of simply throwing a listing on the market and not having to worry too much about any negative response.

Unlike recent past months, buyers now have more options in several areas of the market and, with summer plans mostly concluded, they’re no longer in a rush, despite their commitment to purchase in the Hamptons. Rumor has it that while bidding wars still exist, contracts today are more often the result of a negotiated discount off the listing price than they were in previous months. Reality is setting back in, but closing prices are still at all time highs.

These new options are not yet leading to decreases in overall pricing, but rather more market relevant properties trading faster than the market was able to bear during the months of decreasing inventory. Updated supply numbers will be available at the close of June, but signs point toward what could potentially be the first uptick in monthly listing supply available since late summer of 2020.

After a few quiet weeks, the ultra-luxury market is active once again. It’s no surprise as more properties priced $10M+ have come on the market and others that were already listed have adjusted their pricing in response.

The properties at 1150 & 1080 Deerfield Lane in Water Mill, offered together and listed by William Wolf of Douglas Elliman were originally listed in December 2020 for $18.5 million, raised their price in early March to $19.95 million, reduced back to $18.5 million in early April 2020, and went under contract last week, just 63 days after effectively re-adjusting. Sellers can still ask a premium, but getting even more may be over for some areas of the market.

Buyer leverage appears to be increasing as, if it doesn’t work on this one, it’s more likely now that something else is, or will become, available. “In 2020 through early 2021, I had clients who stayed engaged as ‘backup offers’ – hoping deals would fall through. Some did. Recently, though, people who have been outbid are more likely to explore and act on other options than to wait for a callback,” says RC Atlee of Compass.

Sellers who price or adjust their prices in response to increases in supply for their price point, as well as current market activity in their neighborhood, still have an opportunity to sell fast and for the most money possible in today’s still strong market. Sellers who continue to hold out for more, may risk missing this window.

With all this said, each area and price point is adjusting differently and available inventory varies across submarkets. The first half of June has already seen ten properties close for over the asking price. More detailed market information can be found on HamptonsMarketData.com.