The November Hamptons Market Report

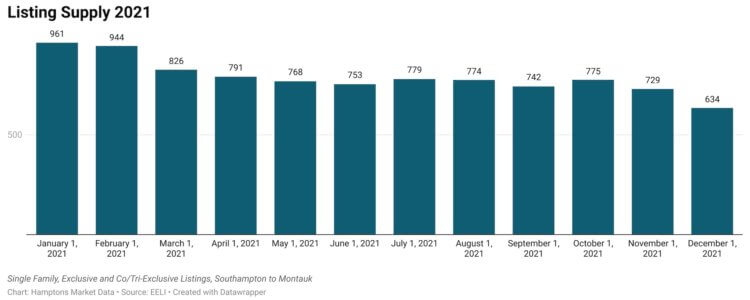

Listing supply dropped 13% between November and December of 2021 — making the Hamptons an even more challenging real estate market in 2021 than it was in 2020 for many buyers. “It just feels like anything I see come on the market, it’s gone before I can even pick up the phone to schedule a showing,” said one despondent buyer recently — who may end up purchasing in Rhinebeck instead.

She sold her Hamptons home in early 2020 and was hoping to downsize locally, but with pricing continuing to increase, as inventory sees no relief, buyers are continuing to be priced out of their home searches.

“I had some cushion to do renovations last year when I started looking, but with how much prices have increased and with the amount of work some of the homes take, I’ve begun to look in other areas to buy,” she concluded heavy-heartedly.

Unlike in 2020, when the number of contracts signed declined during the last quarter, this year’s contract activity has been stable for the last four months, and high compared to market levels over the last four years, though less robust than this time of year in 2020. With supply tightening, the number of days to contract was lower, at 60 days compared to 84 in November 2020.

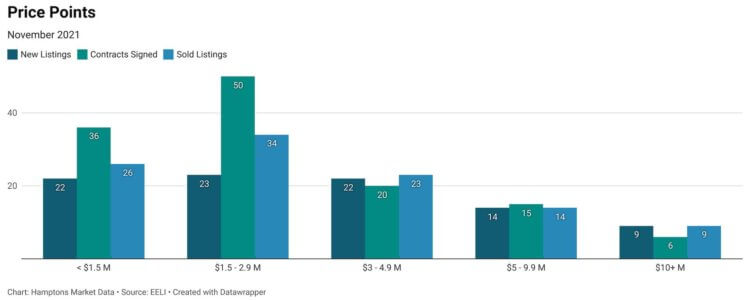

All price points saw a decrease in the number of contracts signed year over year, except the $10M + market segment, which saw the same number of listings sign contracts last and this November. In October 2021, 10 properties closed for $10 million or more. This November, there were nine. The luxury market also remains in strong demand.

Though the number of contracts signed decreased overall year over year, the number of new listings entering the market in the less than $3 million price points had a steeper decline and, when measuring new listings versus the number of contracts signed by price point for November, it’s no wonder that many buyers feel like the market is still moving too fast. The number of contracts signed outpaced the number of new listings to market overall in some impactful price points.

With buyer complaints of high pricing and sellers continuing to reach for record-breaking sales prices, it looked like the trend could have been moving toward buyers having more room to negotiate with sellers this fall, as price reductions have become increasingly commonplace alongside well-priced properties getting snatched up around them, but the median listing discount decreased to -1.14%, an historically low rate.

Though some buyers are being priced out of the market, others are still willing to pay more. In November, the deals to close the most over the asking price were originally asking $7,995,000, $3,495,000, and $795,000 respectively. Though it took a little time to iron out the details, one property in Montauk achieved more than 50% above the asking price, far surpassing the $1 million mark for its closing price.

Going into the New Year, it is typical for Hamptons sellers to take their homes off the market to reset, with the hopes of relisting and selling in the spring. Though this looks to be the trend this year as well, this may be a winter season that sellers may consider staying or even come to the market.

Given encouraging levels of demand compared with low supply levels amid continuing price increases, sellers who price at the most recently traded comparable sale in the area continue to achieve double-digit percent increases over their asking prices.

This holiday season, buyers who achieve a signed sales contract on a Hamptons home are receiving a gift worthy of envy.

Adrianna Nava is the Hamptons real estate market and transaction expert. She is an associate broker with Compass and founder of Hamptons Market Data. Find more of her columns on Behind The Hedges by clicking here.