The second week of March 2020 was the last statistically normal week before COVID-19 shutdowns took effect on Hamptons real estate, causing the number of new and in contract listings to plummet through the end of April 2020.

Many economists predict that the housing market will continue to be strong through 2021 with sales above normal averages, but will return to normal cycles. Comparing the next seven weeks to the same period in 2020 is not going to be overly relevant.

What we can expect in 2021 if the Hamptons returns to its normal seasonal cycles:

New listings will peak in March/April (now). Subsequently, contract activity will peak in April/May. Everyone will go about enjoying summer. Listings from the spring selling season will close and new listings will peak again in August/September. Contract activity will peak August through October. Everyone will settle into the holiday season, listings will close, rinse and repeat.

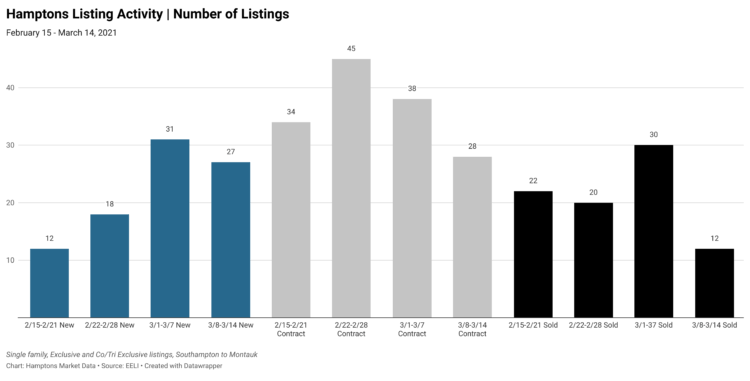

Where we stand approaching the close of the first quarter:

Contract activity has far outpaced new listings to market for a solid six months in a row. If new listings are beginning to peak, it is a proportionately low increase. Market relevant inventory is going into contract within 20 days in the less than $5M price points. For properties priced $5M and above, it’s about 60 days. As a result, prices are improving. Pricing specifics will be available at the close of the first quarter.

Last week, the number of listings that went into contract increased +47% compared to the same week of 2020, but declined for the third week in a row. Sales are outpacing pre-COVID levels; however, the declines in contract activity, likely a response to low listing supply, could indicate a deviation from the normal trend, at least in the spring of 2021.

Sold listing activity also declined week over week. There are 547 listings currently in contract waiting for a closing date, and 29%, or 157 of them, were put into contract in 2020. In 2020, the average days from contract to close were 63 days. January 2021 registered 69 days and February 2021 showed 80 days. It’s taking longer to close.

Reasons cited by agents for delayed closings are buyer or seller life circumstance accommodations, waiting on the completion of improvements, legal issues like holdover tenants, and other delays in the closing process, such as those associated with correcting compliance issues or having to contest appraisals that come in too low. How days to close and pricing continue to play out in 2021 will be impacted by further returns to normalcy continuing into the year.

All areas and price points are performing strongly, but there are a few worth calling out. In the last four weeks, 57%, or four of the seven, $10M+ listings that went into contract were in Bridgehampton. In Southampton’s $1.5-2.999M price point, nine properties went into contract and only two new listings have come on the market. Water Mill had three properties priced $3-4.999M go into contract and no new listings have come on the market.

Unlike 2020, where most bidding wars did not end up in over asking price trades, bidding wars in 2021 so far are mostly resulting in over asking price deals. “There’s no such thing as underpricing in today’s Hamptons market,” explained Deirdre Jowers of The Corcoran Group. “Because of continued strong buyer demand, the marketplace will dictate the price when a listing is brought to the market, often exceeding comparable sold prices,” she continued.

More Hamptons real estate market stats can be found on HamptonsMarketData.com.

Adrianna Nava, founder and president of Hamptons Market Data, is a real estate investment strategist who specializes in The Hamptons real estate market. To read her previous column, click here.