There has been a consistent trend of listings going into contract far outpacing new listings to market since mid-October 2020. Even last week, even though new listings to market increased 72% week over week, in contract listings still surpassed them. The impact of this trend is that listing discounts and days from list to in contract continue to tighten. Agents subsequently have started to report an increase of properties going into contract above listing prices.

Several people have asked me about the impact of recent sales figures on the rental market. Many rental listings in the Hamptons are open listings, meaning no agent has the exclusive listing, rather each agency maintains its own version of the rental listing and a designated agent will keep the rental listing up to date with the homeowner. Only the renting agent will earn any commission. Because of the inconsistencies that tend to arise when there are eight versions of the listing to be kept up to date, and the owner is maintaining their own listings on AirBnB, I had to turn to a more consistent data source to begin to answer.

I reached out to Bryan Fedner and Max Schuster of StayMarquis. StayMarquis is a full-service vacation rental company that helps over 600 homeowners throughout the Hamptons with marketing, booking, rental management and concierge services. They also have access to the best rental data and their pulse on the market trends.

The resulting Hamptons rental market report provided by Schuster is informative, concise, and answers the question perfectly. Given the market’s seasonable nature and variety in rental rate depending on month and day of the week, while most Hamptons areas have caps and limits on short term rentals, it does help to think through market value by breaking down analysis into nightly rates. Schuster reports:

“Three key market trends have emerged during the COVID-19 pandemic: (i) offseason demand has increased materially, (ii) renters are interested in longer term rentals, and (iii) pricing has increased concurrently. These trends reflect both supply and demand side shifts; lower inventory due to homeowners choosing to use their homes themselves and increased demand from renters seeking to vacate metro-areas in favor of more secluded living in the Hamptons have provided a compounding, positive impact on pricing.

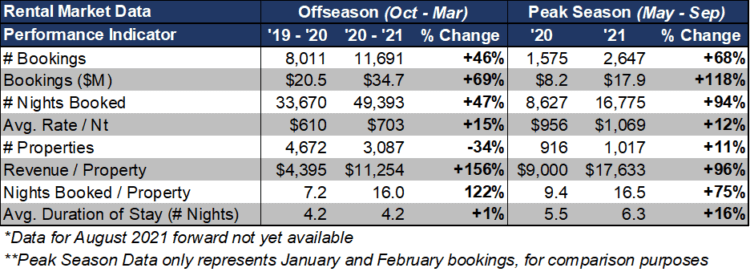

“Increased demand in the offseason has created a significant revenue generation opportunity for owners. Gross booking value increased 69% in the 2020/21 offseason compared to the 2019/20 offseason, reflecting gains in both price and volume – average nightly rate increased 15% while number of bookings increased 46%. As both rate per night and number of bookings have spiked, the overall impact for owners who have listed their properties has been exceedingly positive – revenue per property was 156% higher in October 2020 to March 2021, compared to the same period a year prior. Supply constraints have also contributed to this performance, as the number of booked properties decreased 34% year-over-year.

“Peak season bookings made year-to-date in 2021 vs. 2020 have also soared as a function of the current environment. Bookings made year-to-date for the peak season increased 68% year-over-year, representing renters’ eagerness to return to normalcy in the wake of a full year of quarantine. The average rate per night increased by 12% from $956 in 2020 to $1,069 in 2021(up from $928 in 2019). Higher booking volume coupled with price increases has resulted in a 118% increase in gross booking value for the market year-over-year. Peak season prices in 2021 are materially higher than 2019 and 2020, creating a strong financial opportunity for those owners who choose to rent out their homes this summer season.

“Owners who have not historically rented their properties via online channels have taken notice of the increased activity, duration of stay and quality of tenancy, and as such have continued to turn to these channels to find qualified renters. While inventory has been constrained in the offseason as owners have chosen to use their properties as personal safe havens, the peak season is far enough away that it has allowed owners to plan proactively and take advantage of shifting renter behaviors and increased demand. Booked inventory from May to July is up 11% year-over-year in 2021. Where renting may not have been financially viable for some owners in the past, the current environment provides a financial opportunity that cannot be ignored, as revenue per property has roughly doubled in the last twelve months. Owners currently open for peak season will have supply and demand side factors providing tailwinds to performance.” -Max Schuster, CRO StayMarquis.

The Hamptons recent sales trends, last week’s market stats, and the February 2021 Hamptons sales market report can be found at Hamptons Market Data.

Adrianna Nava, founder and president of Hamptons Market Data, is a real estate investment strategist who specializes in The Hamptons real estate market. To read her previous column, click here.