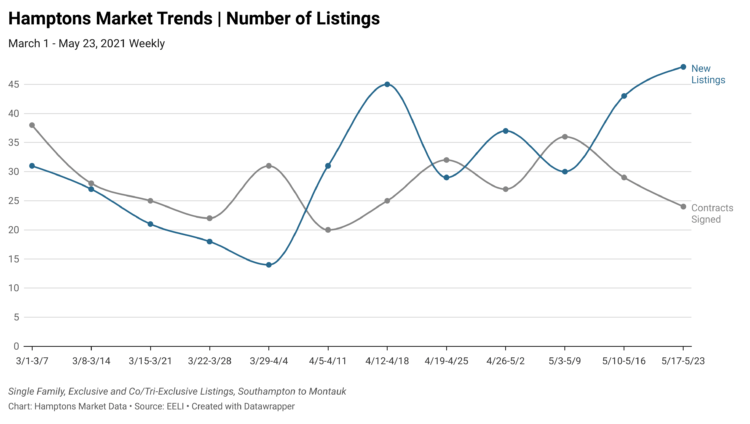

New listings are on the rise while contracts signed, despite a recent dip, have been holding fairly steady since the beginning of April. Days on market continue to remain at all time lows as we approach Memorial Day weekend. Properties signed contracts in a median 56 days last week, May 17 to 23, and properties closed with a median of 131 days on the market.

As more listing inventory becomes available and overambitious sellers look to be adjusting their pricing accordingly, properties are still achieving record price increases. Last week, two properties closed for over $1 million that were listed just below.

The property at 16 Joseph Francis Avenue in Sag Harbor was listed for $999,000 and closed 25% above asking for $1,251,000 just 98 days after being listed for sale by Clare Ambrose of Douglas Elliman Real Estate. It’s not just the lower price points that are seeing competitive pricing, all price points are experiencing properties in good locations with amenities trading for over asking prices.

Over the winter, most properties closing over the asking price were within 5% of the last asking price. Now, the percentages above the asking price are higher, around 5 to 8% in most cases.

That said, there have consistently been 3 to 5 properties closing per week through 2021 for discounts of 10% or more, keeping the median listing discount hovering between 3 to 4% in recent weeks. The development of increased new listing inventory alongside record low days on market requires sellers who are motivated by this strong seller’s market to respond to buyer pricing feedback.

As new listing inventory continues to increase, Hamptons Market Data is keeping an eye on days on market and listing discounts. It’s still a sellers market, but market conditions are changing.