Here in the Hamptons, HREO has been the de facto multiple listings service for the past twenty years or so. But fed up with its high fees, last autumn, several large real estate firms in the area tried to topple HREO from its throne with a new service called the East End Listing Exchange or EELE.

Why has HREO been dominant? (To explain further, HREO.com is the consumer platform and RealNet the broker system; the database both use, all owned by the same company, is called OREX, aka the Open RealNet Exchange.) MLSLI has never gained traction in the East. The reason most East End brokers don’t use MLSLI is simple: with MLS, participants can advertise one another’s exclusive listings, and Hamptons agents don’t want some broker from Ronkonkoma diluting their commission on a valuable deal.

Zillow and Trulia are becoming more and more popular, as they’re pretty and easy to use, but they focus on consumers, not brokers.

HREO/RealNet/OREX, therefore, has basically been the only game in town. In addition to the fees, which could be as much as $1 million a year for a large firm, brokers felt that the company was indifferent to their needs and concerns.

So in fall 2016, a consortium of large real estate firms decided to take matters into their own hands with a new shared listing platform. East End Listing Exchange charged a one-time membership fee (based on company size) and then low annual fees. EELE’s initial rollout including listings from five huge firms: Douglas Elliman, Corcoran, Saunders, Brown Harris Stevens, and Sotheby’s. EELE planned to go live on the web in January, with the member firms planning to switch their listings from HREO to the new platform.

And then, mic drop. January 12, it was announced that Zillow Group had bought HREO.com, RealNet and OREX. Suddenly it seemed like there might be life in the old platform after all.

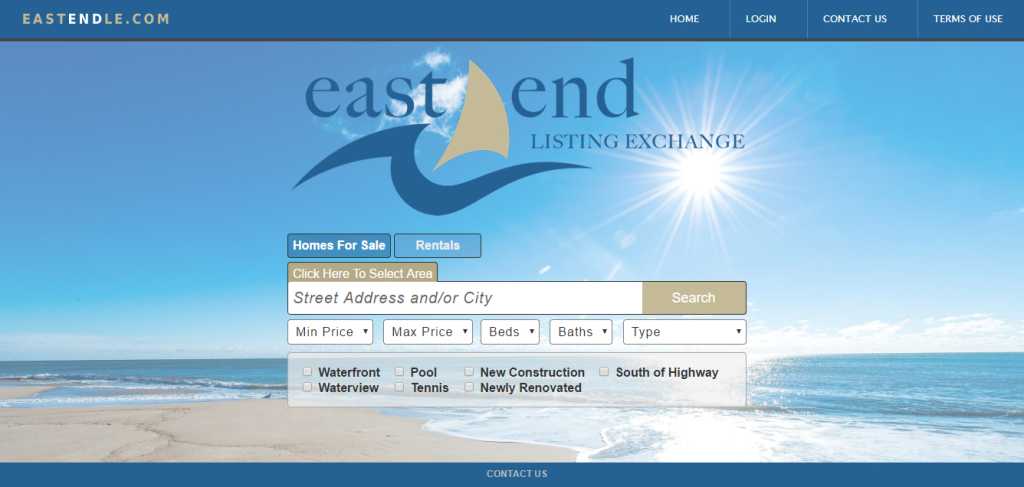

Not helping matters was the Eastendle.com site itself. For consumers, there’s zero reason to use it. It’s not particularly attractive, it’s not comprehensive when it comes to listings, and it doesn’t offer much information. With all the firepower of the participating agencies, why did it look so bad? Why didn’t EELE realize they needed a gorgeous site and a compelling reason for users to go there? Why didn’t they come out with a splashy ad campaign?

As winter melted into spring, many of the firms that were gung-ho on EELE gave up. Elliman and Sotheby’s both stopped inputting new listings into the service, and word on the street is that Corcoran agents have been told not to bother as well. Other larger agencies, such as Town & Country, Compass, and Nest Seekers, never had any listings there.

Geoff Gifkins, Regional Manager at Nest Seekers, told us, “We didn’t join EELE, and most likely won’t if it remains in its current form. Although this was touted as the second coming and revolutionary for the business, it was simply an off the shelf old MLS that they tried to adapt to this market. It failed miserably on all levels, something that should have been vetted well before the launch.

“This was also a for-profit business which would have benefited the founding agencies. That’s a great conflict of interest. The bylaws gave full decision authority to the founding members, not the agent base; this again was poorly thought out and egregious to the agent base it was supposed to serve. We only saw future conflicts waiting to happen. It is unusual for the governing body to control the database and profit from it; these are usually single and separate.

“On a positive note EELE did introduce competition to the market. With the sale of RealNet to Zillow, costs have fallen dramatically.”

As for HREO/RealNet/OREX, according to brokers, it’s become much more responsive to agents’ concerns. Matt Daimler, general manager of HREO/RealNet at the Zillow Group, told us, “Since the acquisition, we’ve been swift to assess and react to pain points from HREO’s customer base. One of those pain points was cost and we have reduced the brokerage membership costs by about 40% on average. We are also heads down with a growing team that’s committed to listening to, and building solutions for, our industry customers moving forward.”

We asked if HREO will have any synergy with Zillow or StreetEasy going forward. Matt said, “We’re still working through the details, but establishing synergy between our brands is always important. Our goal is to help the seller, landlord or broker get maximum exposure for their listing as accurately and quickly as possible. For buyers and renters hunting in the Hamptons, we want to provide them with access to the most comprehensive, accurate source of listings and information. Having information seamlessly move across our brands and platforms is key to attaining these goals.

“We’re excited to rejuvenate and invest in the Hamptons. There is a lot of opportunity to build a stronger, hyper-local resource in the Hamptons—on desktop and mobile—that brings listings, data and content together to help connect buyers and renters with the home they’re looking for. The Hamptons is a unique market and we’re going to build experiences that are tailored for it.”

Looks like HREO’s position at the top of the heap on the East End is secure for now.