This article appeared in the April 2022 issue of Behind The Hedges, Powered By The Long Island Press. A digital edition of the magazine is available online.

Spring has sprung and as people begin to come out of their winter hibernation, potential homebuyers are ready to move. It is estimated that 80% of moves occur between April and September, but in this Long Island market, where demand is up and supply is down, that is no easy task. So we asked some of the top real estate agents from Nassau County to western Suffolk what their best advice is for first-time homebuyers as the market continues to heat up.

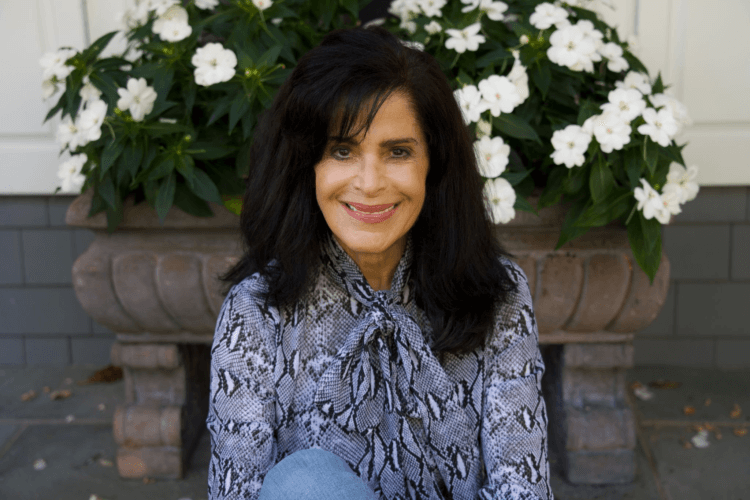

Connie Liappas, Compass

Sellers are in control and, often they themselves, are surprised with the sales proceeds they receive for their home. This climate makes it challenging for buyers, especially first-time buyers. Presently, home prices are overinflated, interest rates are rising, inflation is high, and astronomical gas prices are the norm. As a result, it’s difficult for buyers to save money for a down payment. Additionally, they are often overpaying by 20 to 30 percent more than they anticipated. Most importantly, I advise first-time buyers to review their finances, get an updated preapproval, and be prepared for bidding wars. I often share my first house purchase experience. Financing was at 18 percent interest; however, it was sold two years later at a handsome profit. Regardless of the climate, I advise them to keep on looking. I also keep them calm and hopeful. They need to think logically and explore all options — perhaps expand their options geographically or with the condition of the home. We all love to move into a toothbrush-ready home. However, they command premium prices. Perhaps a smaller house with expansion possibilities or something that needs a renovation can be explored. Another option is to wait it out, extend their current lease for another year. This kind of market is not permanent. More inventory is anticipated in the marketplace in late spring or perhaps summer. It will happen but it may not happen right away.

Jill McDowell, Douglas Elliman Real Estate

In this crazy real estate market, it’s easy for first-time homebuyers to feel overwhelmed. Buyers have to bring their A-game and be ready to play ball and right now, it’s a fastball. Before going out to see houses, I advise first-time buyers to make a list of their likes and dislikes, home styles and amenities that they must have, non-negotiables and things they can live without. For couples, I ask them to make individual lists and then discuss it with each other. The goal is to see if they are on the same page and find some common ground. Do they want a big backyard, a corner property, a fixer-upper? These discussions will help them narrow their search so when they walk into the perfect home, they will recognize that it checks all their boxes and make an offer before they leave. A big must-have is a preapproval and most buyers know this by now. It’s important for first-time buyers to look for home in their price range and stay in that range. Don’t look at homes 200K over your budget and expect to be happy looking at the ones in their budget.

Ann Hance, Daniel Gale Sotheby’s International Realty

We have all heard it by now: inventory is low, housing prices are high, with long lines at open houses! Interest rates are creeping up and demand for the suburbs has never been stronger. How does a buyer land a house in this fiercely competitive market? First: partner with a professional. Find someone who knows the area and has experience to be your advisor. Often that person will have the inside scoop on new listings and can advise how to make your offer shine! Second: Be prepared. Make sure you have a pre-approval from a qualified lender or proof of funds to cover the purchase price. This is a necessary ingredient in presenting an offer. Third: Keep an open mind! Be open to multiple neighborhoods or a house that needs work, but in a great location. Having vision about a home’s potential and the patience to get there, may provide options that others overlook. Remember — it may not be your FOREVER home! Most Americans move every 7 to 10 years. Find a location that offers the lifestyle amenities that meet your needs at a moment in time. Then, give your best offer without hesitation. Happy Spring Shopping!

Donna Quinn, Liffey Real Estate

The key is to work with a local realtor in the area you want to buy. They have their pulse and know what properties are coming on the market soon, which is vitally important as inventory continues to be low across Long Island. More than ever you must be prepared. Keep an eye on your credit rating — it is very important. Be sure to get pre-approved for a mortgage so that when you see something you love, you can jump in with your best number first. If you need a recommendation for a mortgage company to work with, ask your realtor and they can make a recommendation. Remember, your realtor is on your side and there for all your questions and concerns — use them.

Tsui Ying (Judy) Hsu, Douglas Elliman

As this market continues to heat up, first-time homebuyers can do the following to secure their dream home. First step — have a preapproval letter ready to go before house hunting and working with the right agent. This allows the agent to efficiently search for the right potential homes and knowing the budget upfront saves time as well. Next, it’s key to keep communication flowing. Make sure your agent knows your schedule and what you’re looking for at all times, as everyone’s minds and schedules change constantly in this busy world. Houses are gone as soon as they hit the market so you want to make sure your agent can schedule that first showing! It’s also important to establish trust. An agent who you trust and communicate well with will provide that best advice in a bidding war situation. We are professionals who analyze the market all the time, and work for your best interest. Finally — act fast! Often, counteroffers will not even occur. Listen to your expert agent’s advice and put your best and final offer forward. Conquer that bidding war, sit back and enjoy your new place!