The total number of available listings for sale in the Hamptons real estate market declined 40.9% year-over-year for March 1, 2022, but increased 0.2% between February 1 and March 1, 2022. Listing supply has reached a plateau over the last three months, yet the median sold price continues to remain at all-time highs.

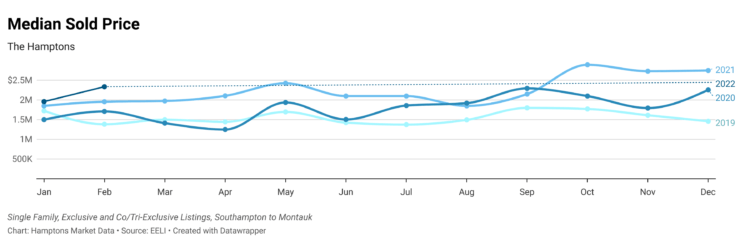

Increasing just over 19% (+19.49% year-over-year and +19.26% month-over-month) for the total market, the median sold price for February 2022 was $2,337,500 — higher than the monthly median sold price of each month in 2020 and the majority of those in 2021. Quarter 4 of 2021 saw the highest median sold prices in Hamptons history due to the proportionately large number of listings priced over $10 million finding deals and closing before the end of the fiscal year.

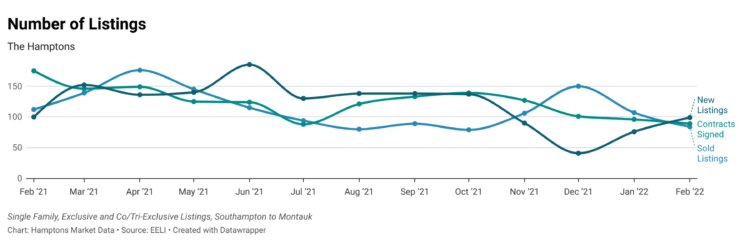

In February 2022, the 99 new listings for sale outpaced the 89 contracts signed for the first time since September 2021. But with only a 10 listing difference, it’s simply not enough to cause any immediate impact on pricing.

Despite the overall market trend, Amagansett, Sag Harbor, and Wainscott still saw fewer new listings than contracts signed, as hamlets, villages and neighborhoods that mimic their feel like Clearwater Beach in Springs, continue to be the strongest in demand.

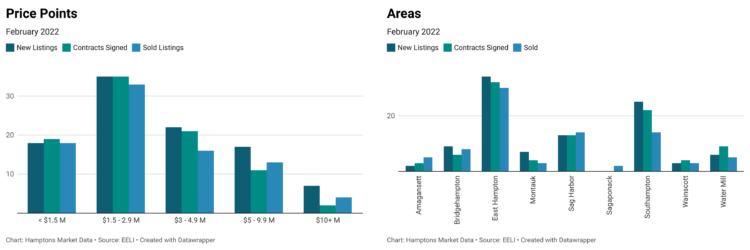

Twenty percent more listings priced over $10 million found contracts in February 2022 year over year and the number of closings was identical, yet the number of new listings decreased by 50% year-over-year. Add to this record number of off-market trades and you end up with the biggest revenue in the Community Preservation Fund’s 23-year history. The luxury market especially is not exactly slowing down.

On the other end of the spectrum, properties priced less than $1.5 million, there were 25% fewer new listings and a 52.3% decrease in the number of contracts signed year over year. These decreases are more so a reflection of there only being 38 available listings (7.7% of total inventory for sale) priced less than $1.5 million on the market from Southampton to Montauk as of March 1, 2022.

The depletion of the entry-level portion of the market can be seen in the 55% decrease in the number of sold listings for February 2022 year over year, alongside an only two listing difference in the number of listings sold in the next price point up, $1.5 – 2.99 million.

The market still needs to absorb and adjust to the 10% increase in land value that occurred in Q4 of 2021 and decide what that means for homes that are of land value, given continued labor and supply shortages, as well as what it means for properties that lack certain equity features, like the ability to add a swimming pool. Move-in ready, which now includes dated but maintained, homes continue to achieve above the asking price deals.

There were more contracts signed for properties priced over $5 million in the Hamptons in February 2022 than in February 2021. In all areas of the market, the listing discount, or percent off of the list price, for which listings continue to close remains at an all-time low at only 2.44% off the list price. When listings are overpriced, data show that in months past, buyers wouldn’t even bother to bid. But some of those buyers who did take the chance to bid a bit lower on listings priced $3 million and below at the end of 2021, were successful at securing up to 16% off the list price.

Is this plateau in inventory the beginning of a turn toward pricing starting to settle, with potentially more options becoming available for eager Hamptons buyers this spring, or is it simply a lackluster early spring market, which is exactly what happened in March of 2021. Time will tell.

View all Hamptons real estate trends at Hamptons Market Data.

Adrianna Nava is the founder of Hamptons Market Data and Director of Market Intelligence for Covert at Compass. Read her previous columns on Behind The Hedges.