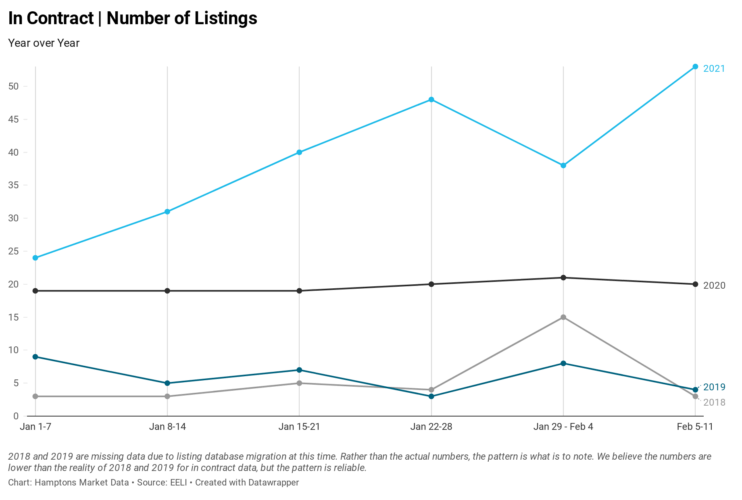

January 2021 had a 37% increase in listings going into contract over January 2020. The first two weeks of February 2021 have already surpassed the entire month of February 2020 for the number of contracts signed, setting the Hamptons up for what could potentially be its biggest sales year of the century thus far.

Overpriced listings and lack of new inventory are still risk factors to continued market momentum, but there is some good news that can help keep the market on track. Forty-five listings went into contract last week, a level as high as some of 2020’s busiest weeks. But 2021 is already different from 2020 and years past.

Last week, 47% percent of the listings that went into contract had at least one price reduction, with 52% reducing since Thanksgiving. Twenty-two of the 24 listings that did not have any price reduction were listed after Labor Day 2020. When contract activity outpaces new listings, as it is now in every price point except $10M+, these price reductions become even more important in keeping market momentum strong.

Price reductions do not mean that prices are going down or that the seller isn’t getting more for their property. More closed listings, as inventory continues to dwindle, leads to increased pricing for those going into contract.

This is best explained with the middle, $3-4.999M, price point. More listings went into contract here last week than any other week in 2021, for a 96% increase on the 2021 weekly average. This in contract activity comes just as more listings in the $3-4.999M price point were noted as closed than also had been any other week of 2021. Sixty-two percent of the listings that went into contract last week had reduced their prices since Labor Day. The house at 662 Lumber Lane in Bridgehampton last traded in April 2011 for $1.875M just after it had undergone a slick modern renovation, and closed again last week for $3M, a -9% discount off its $3.3M asking price, but a 60% increase from almost exactly 10 years ago.

More listings closing keeps the pricing conversation going. Last week, agents recorded 34 sold listings, up 183% from the previous week. Given that Suffolk County is still missing 27% of sold listings from November of 2020, this information is crucial for continued market movement. When a listing is closed and the correct sales price is noted, sellers can gain a better context from their agents for where their property’s market value sits. This Hamptons market is rapidly changing, and correct, up-to-date sold information that precedes county reporting will keep existing listings moving through periods of low new inventory, like we are in now.

Seventy-one percent of listings that closed last week went for a discount. Every listing that closed for more than a 10% discount was priced above $7M, while every listing that closed above the asking price was priced under $1.3M. Prices are going up across the board and a reality check for luxury listing sellers sitting on the market will encourage more improvement in the luxury market.

Some people have questioned me on whether the luxury markets are even seeing much increase in pricing and wondering if these properties have recovered their values since the 2006/07 bubble. This market is nothing like the ’06/’07 bubble for two major reasons. Firstly, the wealth coming into the Hamptons overall is not smoke and mirrors, it’s real. Secondly, the demand for Hamptons properties is staying strong because people are actually changing their priorities and lifestyles. These homes are being used by their owners.

Last sold at the tail end of the ’06/’07 bubble, on January 4, 2008 for $8.7M, 21 Fordune Drive in Water Mill did have some renovations like the primary bathroom, but nothing extensive. It was first listed in September of 2019 for $11.9M, changed agent representation in September of 2020 and went with a new list price of $9.95M. It sold last week, according to the listing agent, for $9.45M. Much less than its $11.9M original asking price, but more than at the tail end of the ’06/’07 bubble plus a few needed updates along the way.

An oceanfront cottage at 2 Town Line Road in Sagaponack last sold in May 2013 for $1.845M. Since then, the existing structure has been fully renovated and exterior features improved, including the addition of gorgeous ocean view decking. It just sold for $7.250M, a 27% discount from its $9.95M asking price. The house at 8 Old Station Place in Amagansett last sold when it was first constructed in March 2014 for $5.3M. It just closed for $6.750M, a -7.47% discount from its $7.295M asking price, but a +27.4% increase from its last trade.

For a more recent example, in our lower price points, 55 Ely Brook Road in East Hampton last sold in March 2018 for $1.2M. It went into contract last week with a last asking price of $1.895M, a 60% increase in just three years with only minor upkeep items completed in that time. J.B. DosSantos of Brown Harris Stevens, who listed the property, was able to put together a creative deal that not only accommodated the lifestyle needs of the seller and buyer through the spring, but that will also put the total transaction amount over the asking price.

“We’re coming up to the 12-month mark of COVID. Leases for people who had committed to 12 months at the start of COVID are going to be expiring. These tenants want to stay in the Hamptons and are evaluating renewing versus buying,” DosSantos explains. “Landlords are asking significantly more to renew than they rented for last year, causing tenants to rush to purchase because they want to stay and can take advantage of low interest rates.”

Trades like these coming through are already starting to increase in contract activity. Sellers are not only gaining a better understanding of their properties’ values going into 2021, but also tenants, who are evaluating how to stay in the Hamptons, are increasingly deciding that purchasing may be their best option. Taken all together, the Hamptons spring selling season has perhaps officially begun in February.

Adrianna Nava, founder and president of Hamptons Market Data, is a real estate investment strategist who specializes in The Hamptons real estate market. To read her previous column, click here.