With summer ending in the Hamptons home sales market, price reductions are increasing in volume and incentives, such as an annual beach club member- ship offered with one home in Montauk, are beginning to appear. Don’t let reduction notices fool you, closed sales prices are continuing to rise and despite many overpriced listings, sellers who price in keeping with market trends continue to be surprised.

This fall, buyers should expect to pay more, but sellers will only achieve the most possible if they strategically position their property offering in today’s marketplace.

The week of August 9 – 15, 2021, recorded a median listing discount of +1.17%. This was the first time a weekly discount percentage has been above zero since the start of the pandemic. The median last asking price of properties with signed contracts in that same week was $3.195 million, well above the more recently typical $1.9 million to $2.6 million range.

Pricing continues to climb, even as volume of activity drops, mostly because of continued low listing supply. Price positioning is critically important if sellers expect to receive an offer yielding the most a property is worth in today’s market. The quality of the offering, including the property’s physical position, construction materials, as well as the features and layout of the home matter much more now.

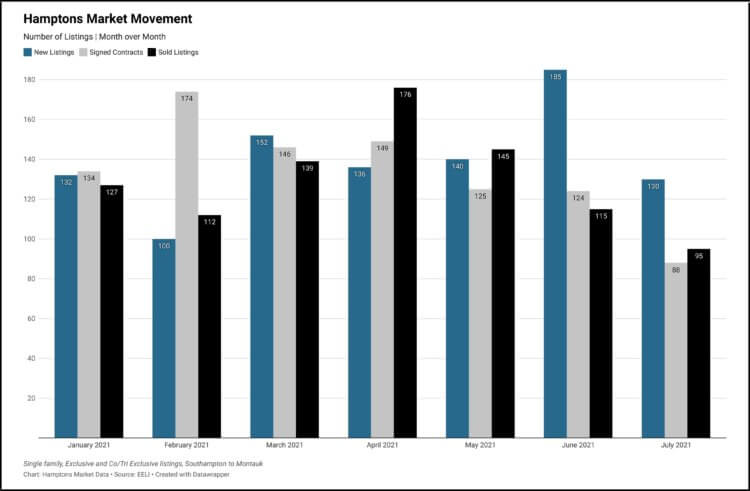

The number of days from listing to contract signed is growing a little bit longer. Different areas and price points have unique factors occurring at the moment that dictate how much more a particular seller can ask, as well as how long it will take for the right buyer to find the listing and submit a bid. Though genuine new inventory is still short, it is in the early stages of inching toward catching buyer activity levels. This will likely take a bit of time. Despite the shift in market activity levels, more likely than not, prices will continue to climb.

Similarly, the rental prices of yesterday are no longer applicable today, at least for short term periods. Approaching Memorial Day 2021, many new Hamptons homeowners decided to take advantage of the sizzling real estate market and offer their homes for monthly rental periods including late July through September and beyond. Much of the long term — or monthly — rental inventory that was late to the market sits untouched, but land- lords were able to capitalize on the last minute short term rental market.

According to our colleagues at StayMarquis, the number of properties measured from August 1 – 15, 2021, offering short term rental bookings increased 12% from 2020 to 2021, and the average nightly rate increased 27% from $1,150 to $1,311. However, there was a 34% decline from the number of properties booked in August 2019. StayMarquis Co-founder and Managing Partner Bryan Fedner credited this to a lack of supply as a result of homeowners choosing to use their properties themselves.

Short term rental demand later into the year has picked up com- pared to 2018 and years prior, according to StayMarquis CRO Max Schuster. Schuster also noted that while increased traffic to the Hamptons market after Labor Day may have been a relatively new phenomenon in 2020, the data supports the notion of a broader shift in renter behavior, rather than a one-time occurrence.

StayMarquis reports that October 2021 so far has more than double the number of bookings than October 2020, while September 2021 bookings have only increased by 6%. That number drops from 2,728 booking for September to 899 in October 2021. Booking earlier also seems to be gaining popularity.

Hamptons property pricing is directly tied to Wall Street due to its natural proximity to New York City. Because the Hamptons is a luxury second home market, putting our unique micro real estate market into a global context is important when assessing real estate today.

Many people have asked us what will happen to the Hamptons real estate market as NYC’s market adjusts. Though the Hamptons is intrinsically tied to NYC, the greater impact on our market will be that of increases to inflation rates, Gross Domes- tic Product, building material costs, projected likely increases in overall wages and labor shortages.

When placing all data into a global context, a picture begins to emerge that shows Hamptons home prices potentially doubling from where they are today in about 10 years.

Adrianna Nava is a Hamptons real estate market and transaction expert, associate real estate broker with Compass, and founder of HamptonsMarketData.com.

This article appeared in the Labor Day issue of Behind The Hedges magazine. Read the digital edition here.