The 2021 Hamptons Real Estate Report provided plenty of nuggets for Hamptons buyers and sellers, but December’s stats can get overlooked. You can’t do one without the other and the month-to-month trend is most critical when comparing the year to previous years – especially when forecasting the Hamptons real estate market for 2022.

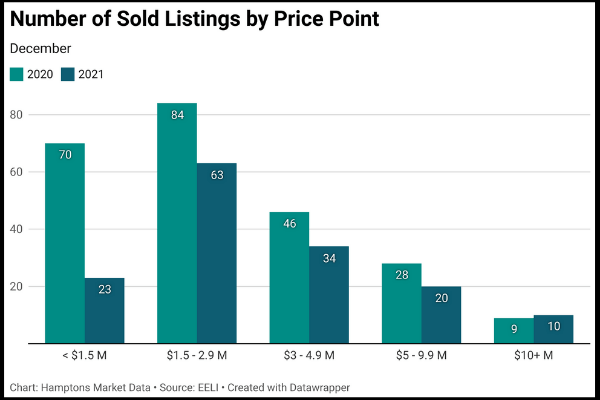

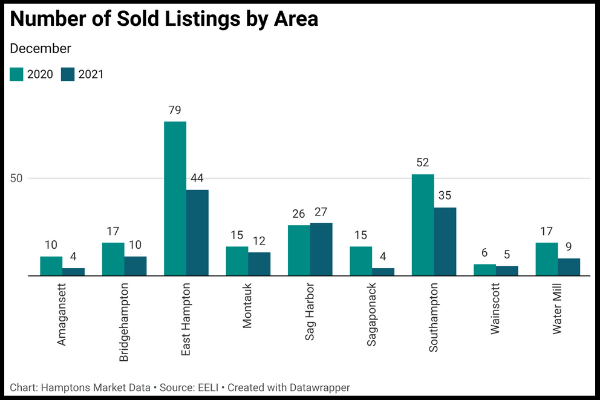

The number of sold listings was down 36.7% in December 2021 year over year, and sales volume declined 42.6%, but the median sold price increased 21.8% (the annual median sold price increase was 18.6%). The largest price gains of 2021 were made in the latter half of the year.

Will prices continue to increase?

The largest decline in the number of sales for December 2021 was in the under $1.5 million portion of the market (-67% YoY). As of the date of this article, there were only 14 listings priced under $1 million available for sale from Southampton to Montauk. More listings broke the $1 million mark in 2021 than ever before – just shy of a 12,000% increase in 2021 compared to 2019, and 9% more than in 2020.

The cost of construction – labor and materials – has increased and this isn’t anticipated to abate, especially with a newly reported inflation rate of 7% – the highest increase since the 1980s. One experienced developer who has a project currently listed for sale anticipates continued or even renewed issues regarding the supply chain, permits and workforce.

Buyers are taking this into consideration as they examine properties that need work. But in the Hamptons, the result of these considerations has actually led to an increase in pricing because buyers in 2021 showed they were willing to pay 10-30% more than a seller was asking, simply for a move-in-ready product.

The cost to renovate and build will likely remain high. It is also likely that within the next 5 years, properties priced under $1 million will be mostly of land value.

The Hamptons cannot create more neighborhoods because we have a fixed amount of land available between the Shinnecock Canal and Montauk Point. The North Fork and west of the canal markets have exploded with our overflow in the last two years as a result. This trend in our outskirts was already underway before COVID and in Q4 2021, land increased another 10% in value as home inventory dropped off.

We anticipate Hamptons real estate pricing overall to remain stable if more inventory graces the market, or to increase slightly if it does not. Yes, mortgage rates will likely increase, but we don’t believe they will rise enough to impact pricing much in 2022. Federal Reserve moves to ward off inflation by increasing rates will be well telegraphed and gradual.

What is going on with inventory?

Listing supply has decreased almost 50% year over year – which is more reflective of activity in the less than $5 million price points. In 2020, 153 properties priced over $10 million came on the market. In 2021 there were 147, but the number of contracts signed in this price point increased by 65% annually.

December stats round it out – the number of new listings priced above $10 million decreased 36% in December 2021 year over year, and the number of signed contracts decreased 44%, but with a sold listings increase of 11% for the month, it is more likely that current (and remaining) luxury inventory comes with sellers who are not motivated to sell – unless that perfect deal comes along, leaving luxury buyers with fewer salable options than it may seem. There are sellers in all price points taking this stance, but due to overall financial position, it is more common in the over $5 million market.

Anticipate salable options to remain few and far between in all areas of the market for the foreseeable future. The only thing we can foresee that may change this forecast is if the rental market tanks this spring and landlords who are overleveraged decide to sell instead. Stay tuned in to Hedges for an upcoming note on the rental market.

What should today’s Hamptons buyers keep in mind?

Many potential sellers we have spoken with are very interested to know their market position and would sell, but are unmotivated to list because they don’t know where they would go instead. This created an abundance of off-market and unofficial listings in 2021. Working with a well-connected agent may bring opportunities unavailable to others. When preparing a bid, try to find out the seller’s motivations so that your agent can help you to prepare an offer that will appeal to the seller’s heartstrings – as well as their pocketbooks.

Do not approach a seller without a very clear picture of your purchase position. You will also waste time looking if you are not prepared to act when that perfect home becomes available.

What should today’s Hamptons sellers keep in mind?

Other markets overall, and all parts of the Hamptons market, have increased in pricing. In pursuing either an upgrade or downgrade, it may be hard to justify a switch as one feels the sticker shock. Having likely purchased in a calmer real estate market, it is important to remember that you are getting the most for your home today and others expect to do the same. When looking to trade up, down or to another market, it is important to remember that the prices you are looking at are and should be reflective of the increases you have also gained.

Real estate agents have their jobs cut out for them in 2022. They will be competing fiercely for the few listings that will likely become available – compared to market norms. Make sure to ask any prospective agent that you are considering listing with about their plans to ensure you get the highest price or sell quickly, if that is the goal, and make sure you fully understand the plan.

Adrianna Nava is the founder of Hamptons Market Data and an associate real estate broker at Compass. Read more of her columns here.