The level of contract activity maintained an upward trend post-Labor Day, while the number of sold listings will hopefully start to catch up to past contract activity. We have heard of quite a number of off-market deals (not included in our data) occurring during this high intensity market. It’s not just buyers who are anxious; sellers have been hearing pricing feedback for a few months. For some sellers, a quick and easy word-of-mouth trade to a vetted buyer feels less stressful than listing for sale in an intense and complicated real estate market.

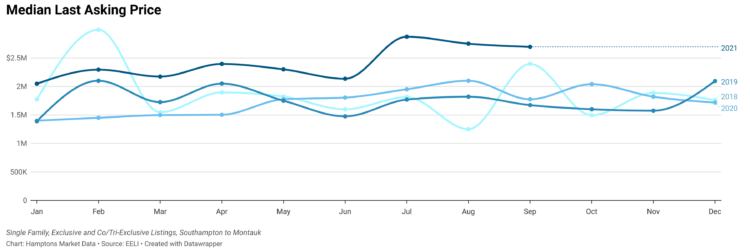

Though the number of new listings coming on the market has outpaced contract activity since May 2021, there was only a 3.7% difference between the two in September. The median list price decreased 17% from August to September, but at $2,695,000 it is still above where it was this past spring and well above the average of the last few years.

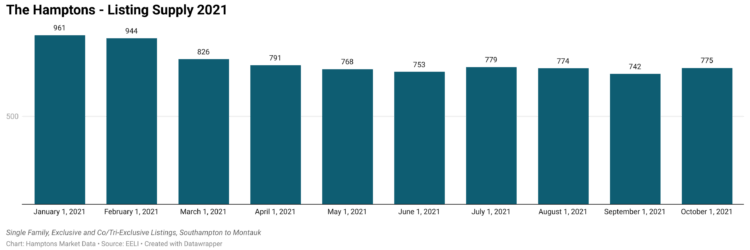

The supply of available homes for sale has been relatively stable for the last 7 months. With only a slight 4.4% uptick going into October, the level of inventory remains historically low. It’s still a difficult buyer’s market due to continued low supply. Approximately 10% of active inventory was taken off the market since the beginning of August. Some sellers decided to stay in the Hamptons a while longer.

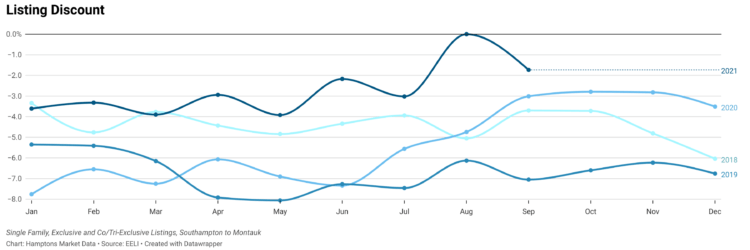

Well-positioned homes continue to achieve over-asking-price deals with September’s median discount coming in at -1.73% off the last asking price. However, as is our prediction for this winter season, the number of days to contract has begun to increase, though only by 9% to a median 70 days from August’s 64 days.

There are still plenty of buyers waiting in the wings, but they are waiting for something in particular. From our own experience, buyers range the gamut – from investors looking for a total renovation for as close to $1 million as possible, to buyers willing to spend over $10 million for a particular view or style of home. New buyers have also entered the market.

It’s coming up on an emotional two years for everyone and many would-be buyers and sellers prefer their next home transaction, whether as an investment or true second home, to feel right. Economists and market analysts have weighed in on market predictions in recent weeks. Some have predicted a downward trend to home prices. Local agents debate this among themselves as well.

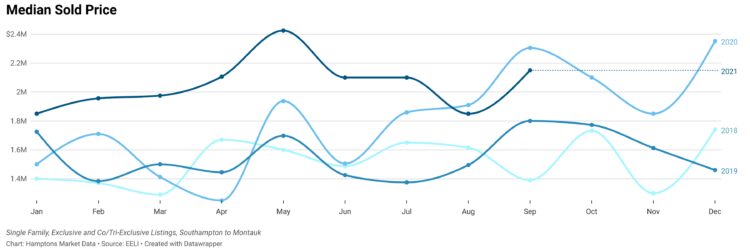

The median sold price decreased 7% from September 2020 to September 2021. But in returning above $2 million to $2,150,000 this September, after a brief dip below $2 million for August 2021- when few high end homes closed, yet plenty went under contract – the median price of Hamptons homes has hovered over $2 million since April. This is still quite impressive compared to historical norms.

The median last-asking-price of homes with contracts signed seems to have plateaued at the highest it’s been since February 2018, which was only so high due to the small number of deals made that month, most of which were priced in the $3-5 million price point, and not an indicator of increase in pricing at that time. Comparing the median last-asking-price over time to the historical sold listing discount shows that real estate pricing has and continues to increase in the Hamptons.

We predict, and many agents agree, that though most recent Hamptons residents and visitors have returned, at least part time, to New York City and other metro areas, few will release their foothold in the Hamptons just yet. Many predicted September would see an influx of listings as summer came to a close. That has yet to happen. We’ll see what happens when September’s extended season tenants move out.

All of the Hamptons real estate market activity charts can be found in the September 2021 Hamptons Market Report.

Adrianna Nava is the Hamptons real estate market and transaction expert. She is an associate broker with Compass and founder of Hamptons Market Data.