The Hamptons Real Estate Report January 2022

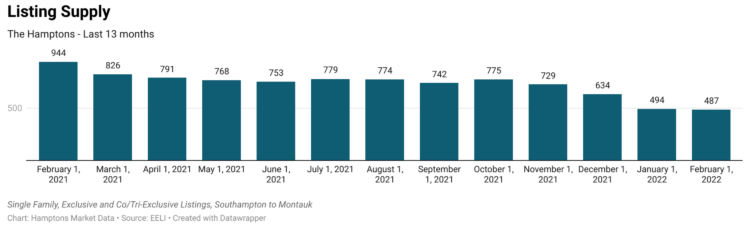

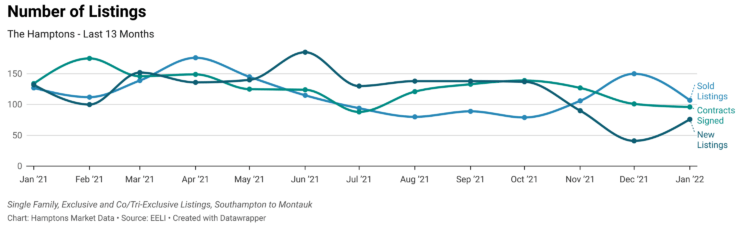

On February 1, the total number of listings available for sale in the Hamptons declined for the fourth month in a row. The decline was only 1.4%, but marked a new all-time low of 487 available listings for sale from Southampton to Montauk. Could this be the start of a plateau heading to more available inventory or will supply shortages persist?

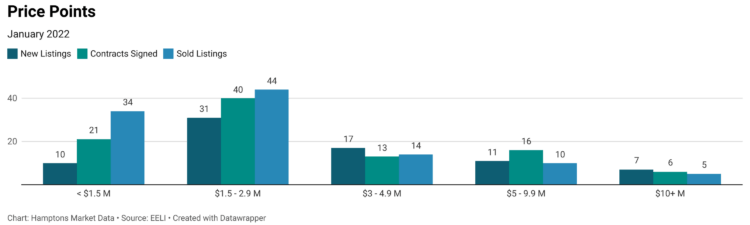

In January 2022, the number of listings priced under $5 million that went under contract and sold declined 30% year-over-year, but 18 new listings priced over $5 million came on the market and 22 went under contract. There has been an increase in off-market activity as well, with several properties priced over $10 million closing and finding off-market deals in January 2022. For example, four trades composing one of the largest waterfront compounds that exist on the South Fork sold for a combined $118.5 million, breaking the record for the second-highest trade in Hamptons history — off-market.

Though some sellers prefer not to have a throng of hopeful buyers knocking at their doors, sellers who can stomach it for a weekend and come on the market at current market value are still signing contracts in less than 30 days. The 90 median days from listing for sale to signing a contract for January 2022 was only 6% higher than December 2021, but homes are still finding contracts 36% faster than in January 2021.

After tapering off in the fourth quarter of 2021, the median last asking price spiked to $2,395,000 in January. With only seven homes available for sale priced under $1 million east of the canal at the start of February, it’s really no surprise sellers are still asking and getting more for their Hamptons homes.

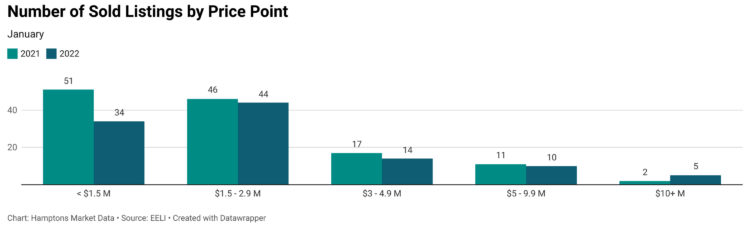

The decline in the number of home trades priced under $3 million is due to low supply, which also has caused many properties to command a higher asking price than ever before. In January 2022, four properties that had been priced under $1 million closed for over $1 million. The majority of homes that traded over the asking price were priced under $5 million.

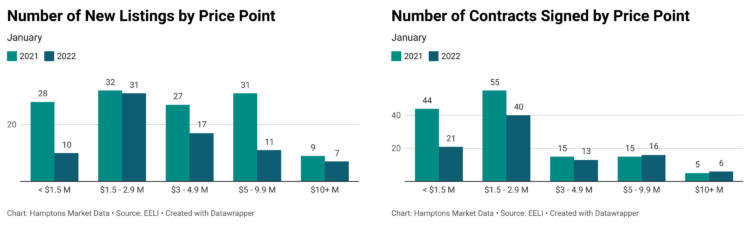

For homes priced from $5 million to just under $10 million, the number of new listings in January was down 63% year-over-year, while the number of contracts signed increased 6.7% for the same period. Properties priced $10 million and above had a 20% increase in the number of contracts signed alongside a 22% decline in new listing supply – while the number of sold listings increased 150% January 2022 YoY.

For properties priced under $3 million, there were 33% more contracts signed than new listings in January 2022. The number of new listings was down 32% January 2022 YoY and the number of contracts signed declined 38% for the same period. Inventory is still being purchased faster than potential sellers can list for sale and the market entry point is increasing as a result, depleting potential inventory in, most obviously, the under $1.5 million price point.

Right now, in the ultra-luxury market, sellers are capitalizing on the abundance of wealthy interested buyers. There has never been such a high and sustained consistency of ultra-luxury properties trading on and off the marketplace.

In 2021, it seemed that within 5 years it would be impossible to find a lot with an existing structure that is priced less than $1 million east of the canal. In 2022, we speed the prediction timeline up to 3 years. Unless something completely unpredictable happens that dramatically alters Hamptons buyer perspective, it will take years for housing supply to catch up with demand and to restore the depleted and still depleting available supply.

Adrianna Nava is the founder of Hamptons Market Data and an associate real estate broker at Compass. Read more of her columns here.