The month of June brought a much needed injection of new listings to the Hamptons real estate market – up 32% in June compared to May 2021. Buyers and agents hoped this could mean a real chance at finally securing the home they or their clients had been after. But by mid-June, when measured week to week, contract activity plateaued, and then plummeted last week. While the 4th of July holiday week likely played a significant role, contract activity has been on a downward trend since February. With the number of qualified buyers still looking to secure a Hamptons home at all price points remaining strong, more inventory becoming available, and homes continuing to close and find contracts at increasing record price tags, what gives?

The numbers prompted Hamptons Market Data to obtain an agent community pulse check. Every one of the agents, comprising all of the major brokerages, who we spoke to wished to remain anonymous and the details of the transactions and properties referenced confidential. Given the sensitive nature of these transactions and a real estate agent’s fiduciary responsibilities to their client, this is understandable. All of them did, however, want to share the current negotiation climate with the buying and selling public.

A buyer finally found a home he thought he had a good chance of securing. He placed a full price, non-contingent offer to appeal to the seller. He knew he was on the clock before other buyers showed up. The seller did not respond. The buyer moved on to continue his search. This story, and others quite similar, we heard over and over.

In this particular instance, “the seller wanted to wait two weeks to experience the ‘selling process,’” agent #1 shared. “The seller wanted and created a bidding war, but the highest bidder didn’t go through with the deal,” agent #1 further explained. This property is still on the market and the first buyer is still looking. We do not yet know if the winning bidder went on to purchase something else.

We asked whether the first buyer would revisit the property now that it is available again. “Unfortunately, since the buyer never got a response to the offer, no,” revealed agent #1. This is where the market is today, potential deals everywhere, but few are coming together.

“Some agents are trying to drive up the prices,” said agent #2. “My buyer made a full price, cash offer and the listing agent didn’t get back to us for three days” agent #2 continued. We uncovered more cases where sellers delayed replying to perfect offers for at least a few days in hopes that more offers would come in and the price would go up.

There is nothing legally wrong with this practice; however, doing so without setting the expectation upfront with the buyer or buyer agent, more often than not, led to increased anxiety for the buyer, hurt feelings, and many potential record setting deals falling apart. However, when effectively communicated, this method seems to have led to quite a number of deals, significantly over the list price, that will be closing. In agent #2’s case, it led to what may potentially be a lower price for the home than a buyer was willing to pay.

“When the listing agent finally did get back to us, he let us know there was another offer and that we would go to a sealed bid. On only two offers! My buyer was so put off that she placed her original offer. She did not win, but it was also not the highest she was willing to offer if the seller had just countered,” agent #2 explained. We do not yet know if the accepted offer is proceeding to contract or for what price.

The data has been fairly consistent over the last two months, with most over asking price trades falling between 1 – 6% over the ask, depending on the property and the ambition of the list price. Then there are standouts that have been closing between 8 – 20% over the asking price. In most cases, when looking at these properties, it is obvious why they achieved the dollar amount that they did. In some cases, sellers were being smart and underpriced a little to bring not only multiple offers, but also the true market value. In others, the home was genuinely unique in its character and/or in a perfect location. But in a few, we’re left scratching our heads.

“It’s these listing agents,” agent #2 insisted. According to this agent, and echoed by a few others to whom we spoke, some agents are leaning into headlines and trying to create activity that no longer exists by stalling on exceptional offers in an attempt to get their sellers the numbers or activity they either promised or the sellers want.

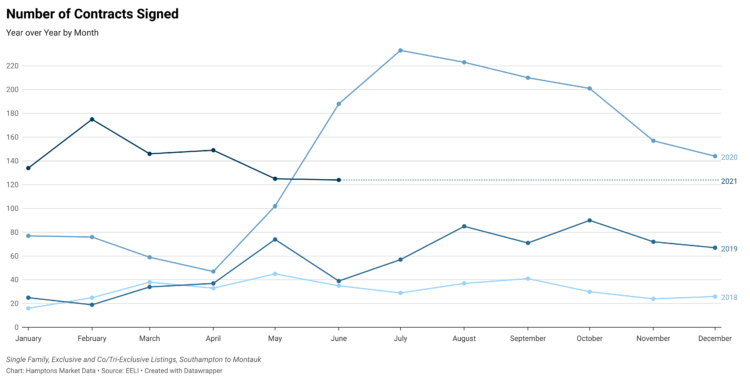

The data show that the level of contract activity has, in fact, plateaued, coming off of the decline that started in February. Contract activity today is 43% less than the average of the three busiest months of 2020 (July – September), but is still approximately 40% above normal market levels. The weekly number of contracts signed trend is, however, continuing to decline as we enter the second half of the year.

“The difference now is, you’re still getting really good offers with some buyers coming in over the asking price, but it might only be one or two instead of ten, like it used to be,” agent #3 has observed. We confirmed this bidding activity with three other high producing agents. Sellers who have priced their homes in keeping with the most recent comparable trades are still being offered record prices, but by fewer or only one buyer. Another agent reported a sealed bid where the initial interest in the property was strong, but only one offer ended up being submitted below the asking price. Yet there are still certain properties receiving many bids when coming on the market.

“Some of these listing prices are just insane today,” commented agent #4. “I don’t doubt there are agents out there who are behaving badly, but I think the majority of it is coming from the sellers,” agent #4 continued. This agent’s buyers won a bidding war on a property that will close for more than 6% above the asking price. “I advised them against going that high, but they wanted the house,” explained agent #4. Regardless of any hype potentially created by an agent, at the end of the day, the buyer sets his or her own limits. The problem seems to be that perpetuating hype that no longer applies to a particular property or area is sometimes leading to no deal at all.

Today’s Hamptons buyers should be prepared that they may have to wait for a response to their offer, especially on a brand new listing. Buyers who are worried about their offers being shopped can put an expiration day and time on the offer, but this approach is only effective if the buyer is fully prepared to walk away. The best approach for a buyer who is motivated to secure a home that is likely to receive more than one bid in today’s market is to be patient and follow the process the seller wants, then be prepared to submit your absolute best and final offer.

Today’s Hamptons sellers should be mindful that buyers are exhausted. A little courtesy can go a long way. Most of them have lost out on several deals already. No one likes to feel like they’re being held over a barrel and many of these buyers have not only been held over them, but beaten in the process. Some agents feel that this sentiment is isolated to the lowest, or less than $1.5 million price point, but we uncovered several cases in the highest price points as well. We cannot share details on any of those, but we can share that less than two weeks ago, one home in Bridgehampton, which is listed between $15-20 million, went into and out of contract on the same day. We do not know the reason.

Sellers will benefit from discussing how incoming offers will be handled with their agent prior to listing for sale. There is nothing wrong with giving buyers a few days to gain access to see the property and prepare their bids when it is first listed. For example, once a seller receives an offer, he or she can start a clock to give others the chance to bid, while responding to the first bidder that others are being given the same opportunity and a response will be given within 48 hours.

This is a very tight market for buyers and asking them to wait any length of time is asking them to potentially miss out on bidding on something else that might come on the market and may very likely lessen their motivation to continue negotiating with the seller. When there are only one or two interested parties at the price in a market where prices are continuing to increase, time is a risky request for sellers to make of a buyer, especially as new inventory looks to be in the early stages of improving from where it has been – listing supply increased 3.5% from June 1st to July 1st and an “I’ll just go somewhere else” attitude appears to be rearing its head.

Agents have expressed that their buyers are much more willing to wait for the right property and a deal that feels right. Sellers should be prepared to lose qualified buyers if they choose a timeframe longer than 48 hours and/or don’t effectively communicate their offer process and timing for a decision to prospective buyers.

Buyer and seller expectations appear to be mismatched as the market adjusts. Agents have been instructing their buyers to submit offers at or above the full asking price in order to secure the deal, despite the feeling of a high price. The problem is, many sellers now see this as a starting point, not the end point the buyer intends it to be. If sellers are not careful in their approach, they risk not only losing buyers, but also potentially not selling as quickly or, as we saw in the case of agent #2, not getting as high of an offer from a buyer as they potentially could have.

What is better – $2.4 million real dollars or $50,000 more in make-believe money that you hope becomes real, but might not? Is it worth risking losing the bird in your hand?

Adrianna Nava is a Hamptons real estate market and transaction expert. She is an associate real estate broker with Compass and founder of HamptonsMarketData.com.