As we approached the end of 2020, many people asked, “will the demand for South Fork properties remain strong as more stability around COVID, the economy, and national politics comes to fruition?” Many had their doubts, but so far, the answer is an emphatic yes.

January 2021 registered a 40% increase in sales from January 2020. The median sales price was up 23% to $1,850,000. Overall, days on market and listing discounts continue to tighten. Thirty-nine properties went into contract the last week of January, a level rivaling some weeks in summer and fall of 2020.

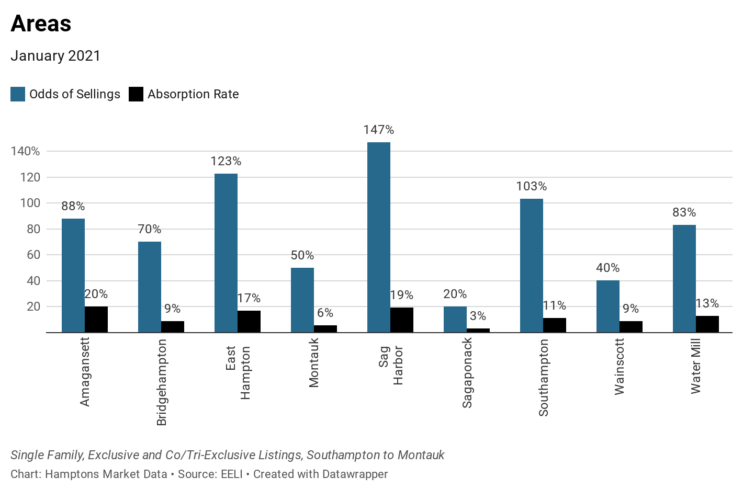

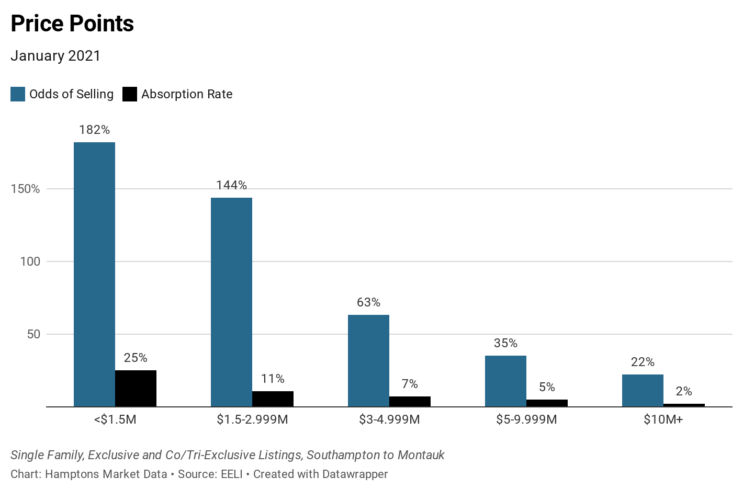

However, not all price points or areas are created equal and we are beginning to see where the market needs to make some adjustments to keep momentum. We have started tracking supply levels, absorption rates and the odds of selling for the various parts of our South Fork market.

Absorption rate shows us how quickly available inventory, or supply, is selling. This number is calculated off of the total supply of inventory versus the number of sales. The most widely accepted measure of absorption rate is that 20% or more is considered to be a seller’s market while 15% or less indicates a buyer’s market. The odds of selling are just that; how likely a listing is to sell within a specific time frame. This rate is calculated from new listings to market versus listings sold. We calculated these rates for the month of January 2021.

But wait a second, you might say, these absorption rates show a buyer’s market in every price point except less than $1.5M! But wait another second, the odds of selling are strong in most cases! What gives?!

The answer is overpricing and, in some areas, oversupply. Wainscott entered 2021 with 78 listings available for sale, hasn’t had a single listing go into contract in the month of January, yet 10 new listings came to market, while only 4 listings closed. Wainscott needs a price correction across price points.

Similarly, East Hampton’s $5-9.999M price point could benefit from some price reductions as could Montauk in the $3-4.999M range. On the flip side, East Hampton and Montauk’s less than $1.5M price points will likely see a continued increase in pricing as we approach spring selling season. Both areas have over 100% odds of selling with absorption rates well above 20%. Sag Harbor’s $1.5-2.999M price point will likely see similar improvements, as could Sagaponack’s $3-4.999M price point.

Things do get complicated in some sectors of the market. East Hampton’s $1.5-2.999M price point is on fire. More listings have gone into contract here than anywhere else on the South Fork in January, with 23% of available inventory already spoken for in the month of January. Sellers here have 77% odds of selling, but the absorption rate is a mere 9%, signaling too many overpriced listings sitting on the market. Sellers are ambitious, but buyers are smart and aren’t going to pay more for tumbled marble from 2005 when the guy down the street had white marble and traded around the same price a month or two ago. Renovations required equal discount to buyers. The mere fact their house exists equals a higher price to many sellers. Stalemate. Sellers should be mindful that while buyers are still very interested in The Hamptons, buyer urgency created by the pandemic has settled.

Also a bit complicated, Water Mill’s $5-9.999M price point has been active, with 5 listings closed and 2 more in contract in January 2021, but Water Mill should be thoughtful in this price point because more new listings came to the market in January than the current demand requires. Sellers here who want to be successful in securing a buyer will need to be priced in keeping with recent sold prices versus what the house next door is listed for and also be competitively priced against other available inventory.

The over $10M+ price point is performing the best in Bridgehampton, but similar to Water Mill’s $5-9.999M market, supply is more readily available for buyers here than most other parts of our $10M+ South Fork market, calling for sellers to be cautious and price competitively to transact. East Hampton and Southampton’s $10M+ price points, though performance through 2020 was substantial, are now seeing oversupply compared to buyer demand. Price adjustments are encouraged here also.

The full January 2021 market report can be viewed at Hamptons Market Data.

Adrianna Nava, founder and president of Hamptons Market Data, is a real estate investment strategist who specializes in The Hamptons real estate market. To read her previous column, click here.