In January 2021’s Hamptons Home Market Report, Hamptons Market Data predicted that it could be as soon as five years that the Hamptons real estate market would no longer see any listings priced below $1 million (except for vacant lots or land value lots in neighborhoods like Springs, East Hampton and similar).

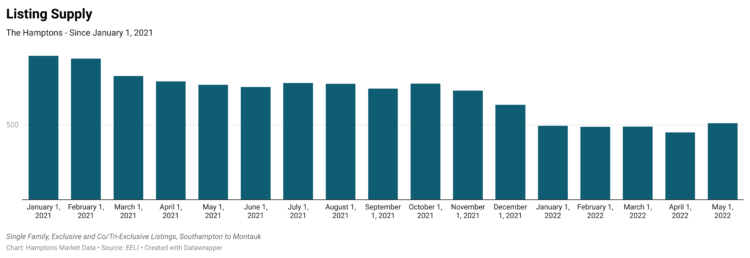

The supply of listings for sale increased 13.6% from 450 on April 1st to 511 homes on May 1st, 2022; however, there are no single-family homes for sale priced less than $900,000 on the South Fork of Long Island anymore … at least at this time.

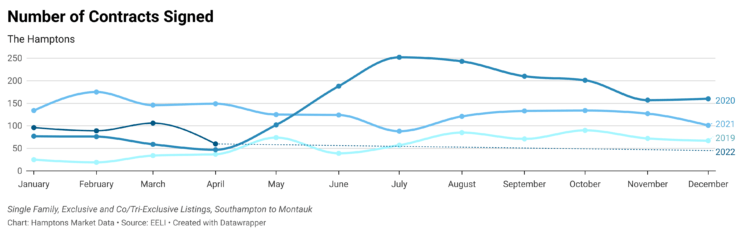

There were 43.4% fewer contracts signed in April of 2022 than in March, and 59.7% fewer contracts signed than in April of 2021. The number of days from listing on the market to having a signed contract fell 25% month over month and 54.3% April 2022 year over year to just 42 days.

Though the number of new listings on the market finally saw an increase (of only 9.28%), there were still 22.1% fewer homes listed for sale in April of 2022 than the same month last year. Of the 106 new listings brought to the marketplace, twenty-two percent signed contracts as well.

No homes went under contract in Amagansett or Wainscott (we cannot believe that no one wants to buy there) and there were still more contracts signed in East Hampton than new listings on the market. Other areas have seen a blip of relief in terms of buyer choices, but activity has still slowed, a typical trend directly ahead of summertime.

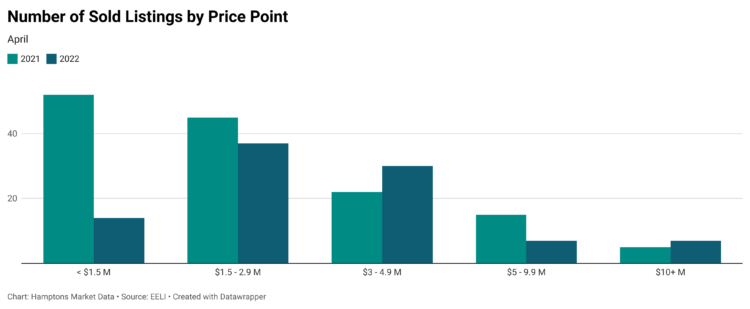

Forty percent more homes priced over $10 million closed in April of 2022 than the same month last year (seven versus five); yet 73% fewer homes priced less than $1.5 million closed (52 versus 14).

When analyzing the trends, it is clear that normal and seasonal market cycles have returned to the Hamptons. This is good news for the market overall as it allows sellers and buyers a chance to think and feel.

The Hamptons is still a top choice second home market, but today’s buyers are taking a breath now, the same as we have seen in the Hamptons rental market. Stagflation is a concern and something we are watching, but ultra-luxury listings are still achieving mind-blowing prices.

There are new homeowners and investors who rushed into the marketplace, who are also quickly learning that the levels of activity and rate of increase the market has experienced over the last couple of years is not the usual way things go and, surprisingly, there is a lot more that goes into owning a Hamptons investment property than they may have realized. How many of these recent buyers will decide to sell as their lives and pocketbooks adjust to new realities, like work from home trends that are increasingly becoming normal, time will tell.

The winter was cold. It was quieter than recent years, but traffic coming in and out of town is an increasing problem as workers and the local population continue to be priced out of the area, but still need to get here to earn a living. Fred Thiele – any ideas here? You did such great work helping out our seasonal rental market.

The more landlords learn of impending anti-landlord rental law changes, like “Good Cause Eviction,” the more may decide to go elsewhere to invest. This author has. New York State is currently an extremely high-risk real estate investment for landlords. It is, however, still a high reward for fix and flippers who are smart.

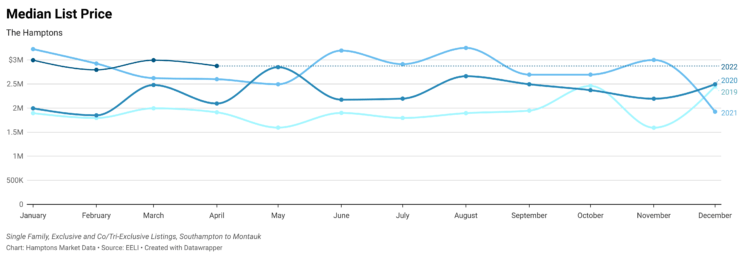

Sellers who are currently listed and have goals to close by or during summer, should consider lowering their prices by about 5-10% if showing activity has slowed down and offers have stopped. Sellers who do not have timing goals, may be able to hit their prices this fall, depending on how demand evolves as people catch their breath.

A reminder that lowering an asking price from today’s high prices, does not necessarily mean prices are going down relative to historically high sales prices. The median list price has decreased both year over year and month over month, but is still 33% higher than the median contract price of $2,249,000. There is room to come down without breaking the improving market. It is just not improving as much that quickly.

Though the number of new listings increased slightly in April, trend-wise, these numbers are still quite low and in perfect keeping with the seasonal cycle. It is unlikely that an injection of new listings this summer will lead to a decrease in pricing from where sales are currently happening, simply due to the percentage increase that needs to occur to return to a stable marketplace (around 1,200+ listings on the market).

Days on market may grow longer as buyers reassess their position and needs, but an injection of new listings could also motivate buyers to place bids on more options. It’s exciting to shop when there is something to see.

In order to successfully list to sell in this market, sellers need to be careful about their market positioning and real estate agents need to be smart about how they market the listing and explain the price to buyers. Blind over asking price bids don’t happen anymore, but considered ones still do.

Adrianna Nava is a licensed associate real estate broker with Compass and founder of Hamptons Market Data.