The number of contracts signed in May 2022 was 44% less than May 2021, but 16.7% higher than the month of April 2022. Despite the drop in activity year-over-year, the last asking price for properties under contract in May 2022 increased 20.4% and 23.2% month-over-month.

The median sales price of $2,559,000 represents a 7.2% decrease year over year and 7.0% decrease from April to May 2022, as the number of sold listings remained flat at 95 sold listings month over month, but decreased 34.5% year over year.

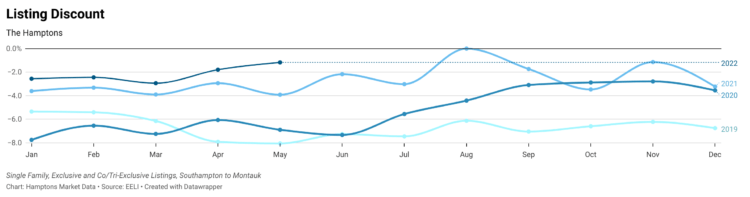

The 151 days on the market is growing a bit longer now, with a 9.4% increase month over month, but still down 36.6% year over year from May 2021. The discount on listings that sold in May 2022 was 34.6% less than in April 2022 and 70.2% less than May 2021 at only 1.17% off the last asking price.

Prices are still historically high and though activity in the $5 to $9.99 million and the less than $1.5 million price points remain strong, the ultra-luxury sector at $10+ million has cooled. While six ultra-luxury homes sold in May 2022, two others went under contract and 15 were new to the market.

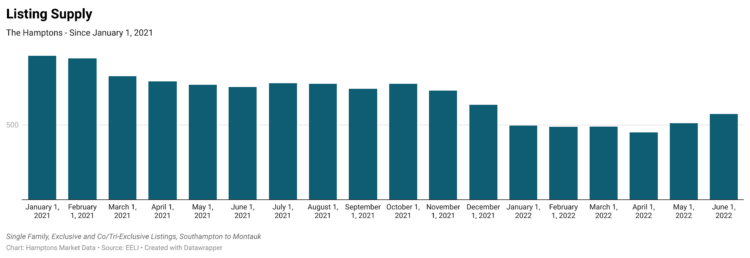

Inventory has not been so gracious in the less than $1.5 million market and less than half of the properties priced between $1.5 to 2.99 million went under contract than were new to the market, leaving the workers who are needed to tend to all Hamptons properties, as well as the people who mind the storefronts, mostly priced out of the area and sitting in hours of additional daily traffic to provide these services everyone depends on. It’s a war on the roads and at the negotiation table in the Hamptons, but sellers are not relenting and holding out for their prices — with one exception.

Properties that have been on the market for 200 days or more are now more common and are the ones taking heavier discounts to sell before anticipated stagflation takes hold. Brokers have been cunning, removing listings and re-listing them to make them seem new. But not all is what it seems and many are not actually “new.”

Thirty-seven of the ninety-five properties that had been on the market for over 200 days closed in May 2022. All except for two closed either at the asking price or for a discount of mostly 5% or more. If you’d like a list of properties currently on the market that have been on the market and changed around their pricing a lot – and to work with someone who can master these negotiations on your behalf, please reach out as these are likely the best properties to get a deal on in today’s market.

If you’ve been thinking about selling, make sure your property pricing and positioning in your area and price point is perfectly right – or you could risk sitting on the market for a while also, as choices re-enter the marketplace, inflation takes its toll on down payment funds, and fear surrounding national and global events continues to give people purchase pause.

That said, the fall could be a robust market as buyers (who are now secured in their Hamptons rental properties) and future sellers take a moment this summer to enjoy the beauty and tranquility of the area, regaining resolve and strength to transact with more vibrancy and perhaps purchase power, for those who chose to skip joining us this year, in the fall. As always, time will tell.

Adrianna Nava is the founder of Hamptons Market Data and Licensed Real Estate Broker with Compass.