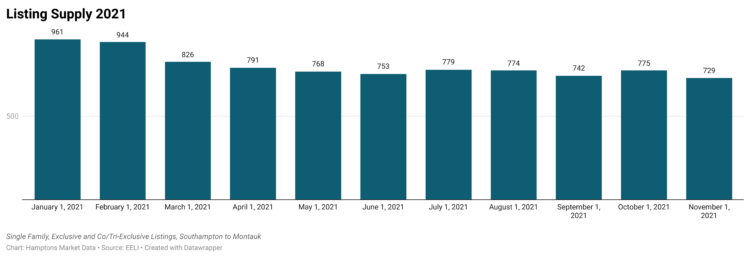

Many speculated that the level of inventory would increase this fall, which is typical after our summer seasons, when homeowners wrap up a final Hamptons summer or shift an investment post-rental.

Not this year.

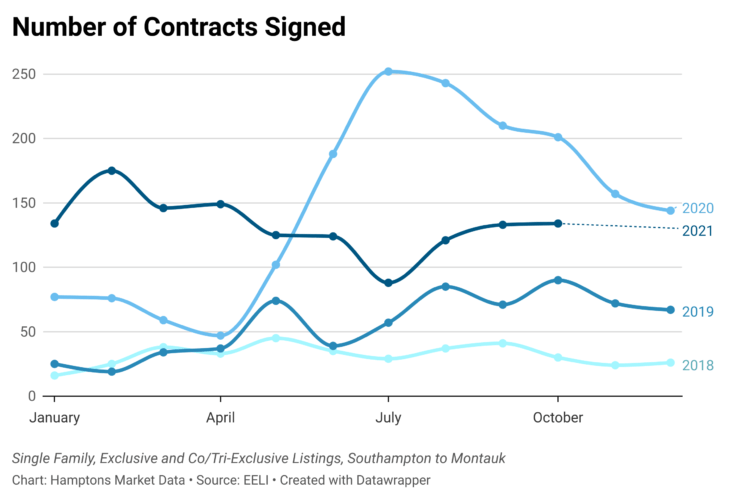

This October, the 139 contracts signed just beat the 137 new listings that came on the market. The last time contract activity outpaced new listings to market was in April. Despite more new listings coming on the market over the course of the extended summer season (May – September), some sellers decided to take their homes off the market and stay in the Hamptons a while longer, reducing the listing supply available to our lowest level in recent memory. Additionally, some of fall’s inventory came on the market over the summer with the caveat — unable to be shown… yet.

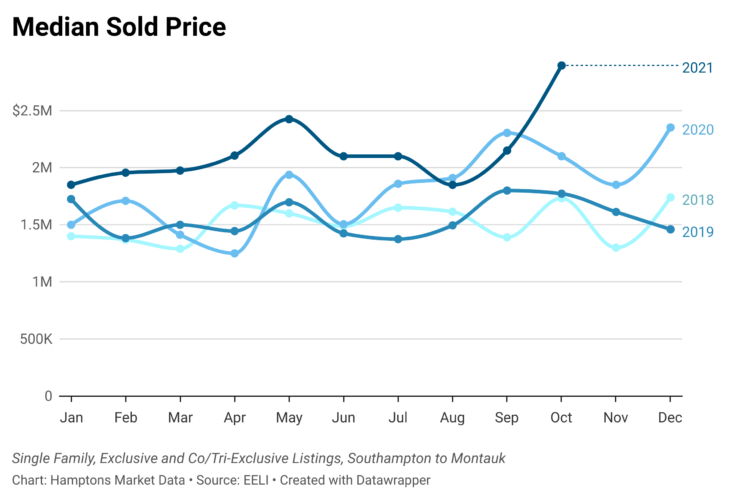

The median sales price skyrocketed 35% from $2.15 million in September to $2.895 million in October. This is mostly due to the luxury market remaining extremely active with ten properties over $10 million closing. Five more went under contract in October, and seven came on the market. Even when removing these properties from the equation, pricing continues to climb in the Hamptons.

Though only 13 properties in the $1.5-2.99 million price point closed in October, 65 went under contract and only 48 came on the market. It’s still a seller’s market and buyers continue to come up against strong competition for homes well positioned in the marketplace.

Price reductions are rampant, but this isn’t new nor is it reflective of overall pricing. Most Hamptons sellers like to test the waters to see how much they can get before realizing that the best way to achieve this, especially in today’s market, is to slightly underprice from expectations to attract the most and strongest bids. Many sellers do not have to sell so, they’re happy to give a reaching price a try.

Despite what is often felt by buyers as pricing confusion, the days from list to close remained in overall decline with sold listings closing in a median of 146 days in October. There was a greater listing discount than we’ve seen in the last four months, but at 3.47% off the last asking price, the discount compared to historical norms is encouraging enough for sellers to continue trying for the highest price in the neighborhood, and many are getting it.

For example, 150 Erica’s Lane in Sagaponack, listed by Dana Trotter of Sotheby’s International Realty, was listed for $7.5 million in June and closed on October 1 for 22% above the asking price, at $9.125 million. On the flipside, 33 Industrial Road in Montauk, listed by Theresa Eurell at Saunders & Associates, was asking $960,000 when listed in June, but closed for 28% off the asking price, at $690,000 in October.

Though the levels of activity are significantly below the real estate market activity of October 2020, the number of days from listing to contract signed has continued to stay steady at a historically low 61 days in October 2021. The number of contracts signed has been on the rise since July, indicating that there are plenty of buyers still looking to purchase in the Hamptons. There is just simply not enough to sell to them. We reviewed some early data with Adam Hofer of Douglas Elliman Real Estate and he put it best, “The numbers sound how it feels — one in, one out.”

This month, we are including a special report brought to us by two members of the local Hamptons community, who reveal the current Hamptons real estate underbelly that very few people are talking about. Despite any possible negative impact to home sales in the Hamptons, the truth is important so — this author can no longer advise anyone who is hoping to purchase real estate here, through a strategy that includes rental income, to do so in New York State. It is just too risky right now and the future remains quite unknown.

While most tenants are honorable to their leases, the bad actors have come out of the woodwork during the eviction moratorium. If the goal is to help support a part-time Hamptons lifestyle, and a buyer does wish to move forward with a purchase supported by any rental income in the Hamptons, either budget for every one to two of five years of ownership to support someone else living in your home without your permission and without payment.

For summer rental offerings, budget to lose a winter and at least one summer out of every five. Alternatively, a buyer could set aside a large lump sum as a payoff to incentive a problematic tenant to leave at the time of the lease expiration. Most landlords of holdover tenancies have been extorted and opted to pay off opportunist tenants, but some are not able to afford to do this and remain stuck at the mercy of the State of New York. Consider all scenarios prior to purchasing residential investment property in the Hamptons.

Adrianna Nava is the Hamptons real estate market and transaction expert. She is an associate broker with Compass and the founder of Hamptons Market Data.