“When the raw data came to me for the first 3 months of 2023, I cringed before even opening the tabs,” Judi Desiderio, the CEO of Town & Country Real Estate says in her first quarter home sales report, issued this week.

All 12 markets that Town & Country monitors showed decreases in the total number of home sales, in addition to the decline in the total sales volume, proving buyers are taking a pause.

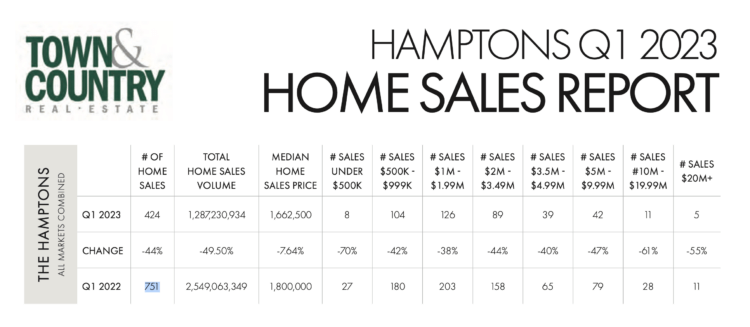

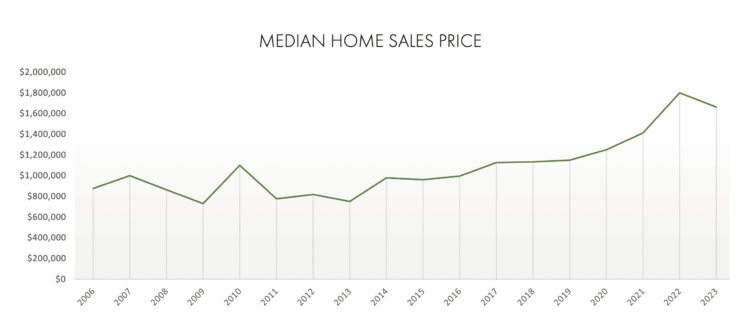

“But the big takeaway,” Desiderio says, “is the drop in the median home sales price, down -7.64%.”

This marks the first decline in the median home sales price since 2019.

“As any Hamptons real estate broker will tell you, business took a turn in June 2022 then went on vacation elsewhere from Thanksgiving through February. Therefore, it is no surprise that the Town & Country Q1 Home Sales Report shows a lot of red.”

Desiderio says “the retreat began with interest rate hikes at an unprecedented pace, due to the highest inflation in four decades, not to mention a stock market that gave even a seasoned investor whiplash, while geopolitical tensions escalate and a ground war ensued, the likes of which we’ve not seen in decades.”

Looking at all the Hamptons markets combined, the home sales activity was down -49.5% compared to 2022 and there were -44% fewer total number of home sales for the same period — 424 sales as compared to 751. The declines were across each sales category, whether it was under $1 million or over $20 million.

In the first quarter of 2022, the median home sales price in the Hamptons was $1.8 million. So far this year, it’ comes in at $1,662,500.

Montauk saw only 16 house sales close in the hamlet in first quarter, a -57% drop year-to-year. “But let there be no mistake, the interest in our fishing (and surfing) capital of the East End remains strong,” Desiderio said assuredly.

Amagansett also experienced a -64% decline in the total number of sales with only 10 in the first quarter. “This resulted in a -72.16% loss in total home sales volume from $153,845,999 in Q1 2022 to a mere $42,825,000 in Q1 2023,” the report said.

In Bridgehampton, which includes Water Mill and Sagaponack in this report, “rode right on the heels of Amagansett with -62% fewer total number of home sales and a -71.25% drop in total home sales volume,” the report says, adding that’s

“A significant decline from one of our top producing areas.”

The median sales price also dropped 15.48%, from $4,688,500 to $3,962,500.

“There was a shining beacon in East Hampton Village where the median home sales price logged in at $6,750,000,” the report continues. “While statistically, that was only a slight increase of 1.12% it demonstrates the strength of our East Hampton Village homes.”

On such sale, though an outlier, was 32 Windmill Lane and 26 Windmill Lane in East Hampton, which sold in two separate transactions — $77,775,000 and $13,725,000 respectively — back on January 11. There was also 100 Further Lane, the Norman Jaffee-designed house that sold at auction for $16.8 million.

The East Hampton area, which for the purposes of the report includes Wainscott, saw the most home sales close in the first quarter, which led to the largest home sales volume at $228,609,351. Even still, it was -38% in terms of the number of home sales and -35.38% in terms of the sales volume when comparing it to the same period in 2022.

Sag Harbor Village holds the distinction of suffering the greatest decline in total sales with -67% year-to-year. Only nine village houses traded in the first three months of the year.

In the report, the Sag Harbor area includes Noyac and North Haven Village, and that area, however, showed the greatest increase in the median home sales price with a 32.93% increase from $1,875,000 to $2,492,500.

“Impressive considering there were -39% fewer home sales,” the report notes.

Over in Southampton Village, there were 18 residential sales in the first three months of 2023, a -47% decline over the first quarter of ’22. The total sales volume also sank — a whopping -65.15%. The median home sales price also decreased -11.85%.

As for west of the Shinnecock Canal, there were some climbs in the median sales price.

In Westhampton, which includes Remsenburg, Westhampton Beach, East Quogue, Quogue and Quiogue for the purposes of this report, the median sales price increased 5.56% to $1.425 million from $1.35 million “showing the trajectory of our western markets.”

Hampton Bays also inched up by 3.32% to $777,000 from $752,000. “Keep an eye on this gateway community, it has far to go in my professional opinion,” Desiderio wrote.

A report on the North Fork real estate market will be posted Thursday.

Email tvecsey@danspapers.com with further comments, questions, or tips. Follow Behind The Hedges on Twitter, Instagram and Facebook.