A Hamptons oceanfront compound sold for $91.5 million in an off-market deal in January, raking in more than double what it sold for just three years ago.

The trade also sets the threshold high for what could easily remain the most expensive trade of 2023.

Suffolk County deed transfers available on Friday show that 32 Windmill Lane and 26 Windmill Lane in East Hampton sold in two separate transactions — $77,775,000 and $13,725,000 respectively — back on January 11.

The 6.7-acre estate, at the end of a private road off the famed Further Lane, sold in April 2020 for $45 million. Broken down, the deal yielded $37 million for 32 Windmill Lane and $8 million for 26 Windmill Lane. At the time, it was the largest sale on record in the Hamptons since 2016.

The mystery buyer then quickly put it back on the market in October 2020 for $72 million.

While it took some time to sell, that’s a $45.5 million flip in less than three years.

The January 2023 buyer’s identity was shielded by a limited liability company called Newco Windmill and Newco Windmill 2, both of which were created in September of 2022.

Union Pacific Former President and later Chairman of the Board, James Evans, created the compound in 1989 and his family inherited it after his death in 2015. The 2020 buyer’s name was shielded too with the use of an LLC, but The Wall Street Journal identified him Friday as real estate developer Peter Fine.

Martha Gundersen and Paul Brennan of Douglas Elliman and Valerie Smith and Frank Newbold of Sotheby’s International Realty had the co-exclusive when the property sold in 2020. Gary DePersia repped the buyer and the listing once it went back on the market, though it was removed in 2021.

It was not clear who facilitated the most recent deal.

Hamptons Property Can Be Expanded

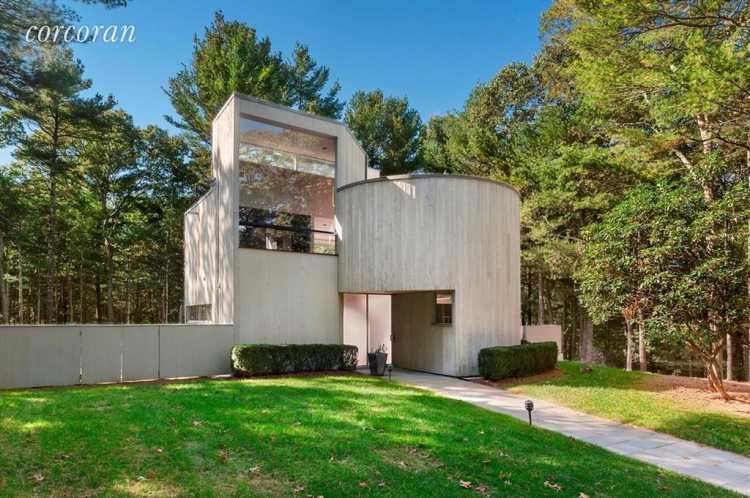

The two separate parcels are comprised of a 5.4-acre property that includes a 5,500-square-foot, five-bedroom, six-bath main house, designed by architects Zwirko & Ortmann, and a nearly 1.3-acre inland parcel with a four-bedroom, two-and-a-half-bath guest house.

Described as “immaculate” in the listing, the main residence features cathedral ceilings in the living and dining rooms with doors that open to an oceanfront terrace. The manicured grounds hold a 50-foot heated pool and a private path to the beach. The property offers 300 feet along the ocean.

The smaller lot also boasts a pool.

There is room for expansion without variances being required. A north-south-facing tennis court could be added along with a 60-foot-long oceanside pool.

Zoning also allows for an approximately 12,477-square-foot to be built on the primary lot with a fully finished lower level, as well as an approximately 6,040-square-foot cottage, also with a fully finished lower level on the smaller parcel.

While the $91.5 million sale could easily be the biggest residential trade the Hamptons will see for the year, it does not create a new record.

In 2014, hedge fund manager Barry Rosenstein famously paid the most for an estate when he shelled out $147 million for three separate, yet contiguous parcels on Further Lane. The biggest of the properties at 62 Further Lane traded for $97 million, just shy of $20 million more than 32 Windmill Lane.

Jule Pond, a 42-acre waterfront estate in Water Mill, also sold for $105 million in October 2021, breaking the record for the biggest trade in Hamptons history for a single property.

In Water Mill, four trades composing one of the largest waterfront compounds that exist on the South Fork sold for a combined $118.5 million in 2021, the second-highest combined trade in Hamptons history.

Email tvecsey@danspapers.com with further comments, questions, or tips. Follow Behind The Hedges on Twitter, Instagram and Facebook.