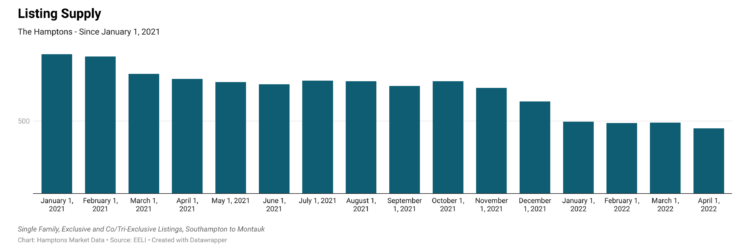

The supply of real estate listings for sale in the Hamptons fell to 450, dropping 8.1% on April 1 month over month and is almost 55% lower than the same time last year, making this month the largest year over year decline in real estate inventory since this data has been measured.

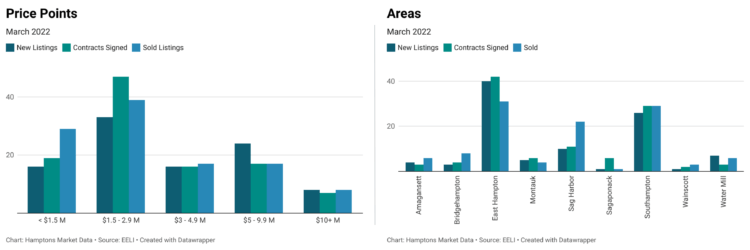

The number of contracts signed outpaced the number of new listings brought to the market in all areas except Amagansett and Water Mill, which had fewer listings sign contracts in March 2022 than in March 2021. Overall, there were 17.4% more contracts signed in March 2022 than in February, but almost 32% less than in March of 2021. Water Mill had 86% fewer sales in March year over year, yet more listings sold in Amagansett in March 2022 than the previous year while Amagansett had 111% fewer new listings.

For properties priced over $5 million, there were more new listings than contracts signed for March 2022, but 33% more properties priced over $10 million found contracts in March 2022 than the same period last year, and 46% more luxury properties closed in March 2022 than the previous year. The luxury market is still incredibly active.

There were half as many new properties brought on the market priced under $1.5 million, 85% fewer contracts signed, and 57% fewer properties sold. One recent home investor commented, “Under a million? I’m realistic, that doesn’t really exist anymore.”

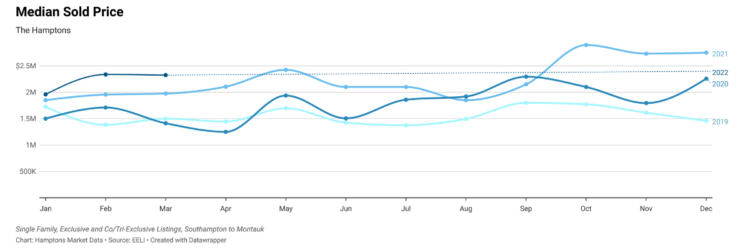

The median sold price increased 16.3% in March year over year and 0.5% month over month to $2.325 million. Hamptons home pricing is still on the rise, but increasingly now gradually versus exponentially as it did last year. If a property hasn’t found a qualified buyer within 60 days, the property is either overpriced or not being effectively marketed. Today’s buyers will wait unless they see and feel value in the property offering.

Sellers who closed in March 2022 were 18.6% more negotiable than those who closed in February 2022 but still 28.1% less negotiable than sellers in March 2021. Properties are still finding contracts and closing quickly.

Bidding wars are still commonplace and, given that there is so little for sale, it is no surprise that the median number of days from listing to signing a contract decreased 42.3% month over month and 89.7% year over year to 56 days – the lowest it has been in three years. The house at 27 Kings Point Road in Springs, priced at $2 million, signed a contract three days before it went on the market as already pending. It last sold in October 2020 for $1.395 million… The buyers turned sellers did put in some new furniture.

The Federal Reserve is taking steps to combat inflation and rein in home price growth, mostly by increasing its interest rates. While this activity is being monitored, Hamptons homebuyers should note that these efforts by the government are to curb, not stop, or drop, home price growth. A reminder to home sellers who are holding out for more, the cost of home maintenance, upkeep, construction and financing continues to rise. It remains an excellent time to both buy and sell Hamptons property.

View all Hamptons real estate trends at Hamptons Market Data.

Adrianna Nava is the Director of Market Intelligence for Covert at Compass and founder of HamptonsMarketData.com.