A new year has arrived and we’re all hoping for a strong 2023 ahead, particularly when we’re talking about the economy and real estate. After an unprecedented few years, we’re curious (and maybe a little anxious) about what changes we can expect in the market going forward in the new year. We asked some of the top agents on Long Island: What are their predictions for the Island’s real estate market for the year ahead?

Peggy Moriarty

Daniel Gale Sotheby’s International Realty

Cold Spring Harbor

“The main problem affecting the Long Island market is the lack of inventory. I have a long and strong list of people who would buy tomorrow if the product was right for them. Pricewise, if there is a property under $1 million that is in good condition, it’s going to sell right away. People need to buy houses and will. While there is a dearth of inventory between $1 and $2 million, between Thanksgiving and Christmas I created five pending sales over $1.5 million. As for mortgage rates, buyers got spoiled by a false market of historically low rates that were unstainable. Today’s rates represent a more normal market and ultimately will not stop buyers. More importantly, there’s a market stalemate as people want to sell, but there’s no place to go. Younger people moving from the city don’t want two acres and have neither the time, vision, nor cash to renovate, but will roll updates into the mortgage. For a fixer-upper to sell, it has to be priced to sell. The market remains strong, but inventory must rise to meet the demand and keep it strong. It will be interesting to see what the new year brings.”

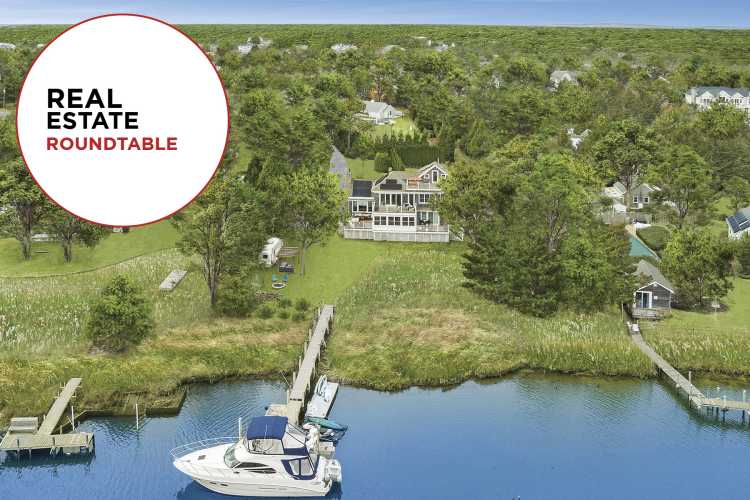

Abigail Mago

Fire Island Sales & Rentals

“Despite all the doom and gloom in the headlines, on Fire Island we are experiencing record low inventory and prices continuing to climb. We usually see four to five times the number of homes on the market than are currently listed. Going into 2023, I think we will see prices continue creeping upward, albeit at a slower pace than the dramatic price increases since 2020. I do think we will see the number of transactions decline because inventory is so tight. Fire Island has always been a remarkably resilient market and represents an amazing value proposition relative to the cost of Hamptons real estate. Here you can still get a trophy property for $4 or $5 million. It can be ocean-front property or a fabulous new construction. You can view a home with all the bells and whistles, that’s a three-minute walk from the beach (and under 60 miles from Manhattan.) A lot of people, who might not have considered Fire Island in the past, are looking at the value, the convenience and the appeal of car-free living and realizing it makes a lot of sense for them. I think that trend is going to continue in 2023 so I remain bullish.”

Michael Stanco

Principal of the Stanco Misiti Team

Compass

“The Long Island market remains resilient, particularly on the North Shore of Nassau County. I expect future pricing to continue to be based on the supply limitations we see in certain submarkets. Now more than ever is the right time to connect with an experienced realtor to navigate the negotiations of any property based on a holistic review of the comparables in a particular region over a number of years. Sellers too should evaluate their properties based on the last 5-6 years to gain some perspective on their properties’ pricing. A few other factors to consider: Values have stabilized and are still strong. Migration out of Manhattan and the boroughs has kept demand up. The fluctuation of interest rates can change people’s financial calculations overall, but what has remained constant is that Long Island is a desirable destination because of the beauty of its homes and the high quality of life it affords. In the long run, the planning to supply the island with a variety of housing options has to endure to keep buyers at all prices engaged. On the North Shore, The Residences at Glen Harbor is our newest waterfront condo building listing developed by Racanelli Construction Co Inc. offering amenities for buyers who prefer easy maintenance-free living outside of the single-family options on the market. Increasing the housing supply is an issue that will need answers for the foreseeable future.”

Michael Petersohn

Brown Harris Stevens

East Hampton

“I am excited for real estate going into 2023. While most of the prognosticators are predicting gloom and doom on a national level, I am optimistic about the local markets. There are three factors in my mind that will keep prices steady or growing this year. I don’t expect everyone to agree, but that is what makes a market! The supply chain is rapidly catching up and inflation is dropping precipitously. While it feels like this has not translated to the grocery store just yet, I can say that steel, lumber and WTI Oil futures are all trading now just above their pre-Ukrainian pricing. Prices will begin to fall quickly at Home Depot. Wall Street bonuses will be lower by 30%. This was a tough year for trading as volatility rocked the markets again and again. That said, approximately $63 billion was paid out last year and 70% of that is about $40 billion with a chunk of that coming east. Lastly, it is a lack of supply. We all expected a flood of product to come on the market this fall, and it was more like a trickle. The numbers mid-December speak volumes. From Montauk to Westhampton 10 new listings came on the market while 26 sales were closed and 18 went in contract. Fence sitters will be left flat-footed.”

Sheri Winter Parker

The Corcoran Group

Cutchogue

“I see a lot of opportunity as we enter 2023. I’m pleased to report that I’ve seen activity pick up in December and clients I’m working with are still looking and are motivated to buy. On the flip-side, I have sellers who are planning to list their homes in early ’23, so the market is definitely active. In the new year, I do think the most important factor will be pricing properly and working with a seasoned agent who has experience in all types of markets. I expect steady conditions, with unique/special properties faring very well and pricing to be more in line with the market as we get further into the year. I also believe that East End rentals will fare better than they did in ’22. After so much international travel over the past year, many people may be looking for a getaway closer to home.”

This article appeared in the January 2023 issue of Behind The Hedges Powered By the Long Island Press. Read the full digital issue here. Take a look back at 2022 with our year-in-review.