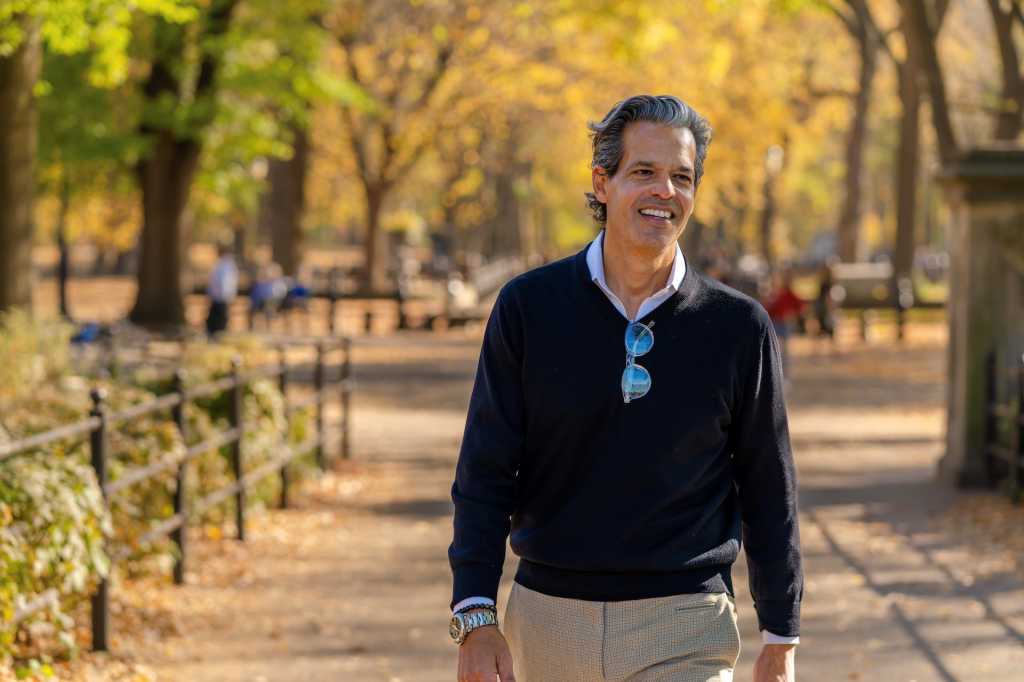

We caught up with Roberto Cabrera, a real estate broker with Brown Harris Stevens, known for his high volume and expertise in residential sales in Manhattan.

Based on the Upper West Side, which he’s called home for more than two decades, Cabrera is continually ranked at the top of the brokerage. He has also been ranked nationally by REAL Trends as one of “America’s Best Real Agents” for having an average sales price of $4.35 million.

Cabrera’s blend of NYC knowledge, strategic acumen, analytical rigor (he has a degree in Mathematical Economics and a background in finance) and personalized service makes him a standout in navigating the city’s distinctive landscape.

He’s also the host of The Roberto Cabrera Report, a monthly podcast and video series sharing timely updates on the city’s ever-evolving marke, covering interest trends, rentals, development, and actionable insights, so we asked for his take on the current real estate climate.

BTH: As the summer season heats up in the Hamptons, the city tends to be quieter, leaving those of us who keep an eye on the market back in Manhattan to ask that age-old question: How is the market? And what will it be like when we’re ready to return for the fall?

RC: Funny you should ask that question, as it is not particularly a seasonal question, but one that gets asked year-round. And of course, everyone’s favorite answer is, “Well…it depends.” And it depends on what segment of the marketplace you’re inquiring about. Generally, summer tends to be slower deal-volume-wise, but it can still be intense with “real” buyers, who can seize a great opportunity while others are away, playing, so to speak. When you come back from summer, you can always expect to see new inventory (choice) and new buyers (competition). You have to figure out your level of digestion is for the process. What segment are you in?

BTH: Are the trends you are seeing directly related to announcements of tariffs, or was it already on the current trajectory?

RC: Any actual effects of tariffs have been unseen thus far in the metrics … interest rates have not done much, and both inventory and deal volume have been moderate. Where we have seen some hints of an effect have been in sentiment, as some put a pause on their endeavors to buy or sell. It has really been a useful narrative (an excuse) for those who have not yet been serious about a move.

BTH: As changes are afoot on the rental market and with rents setting records for the third time in four months, how does that impact the other segment of the market?

RC: That’s a tough one. We hit record highs before we reached the busy season and just this month the FARE Act was passed and resulted in a seemingly 10-11% overnight spike in rents. Regardless of perceived high interest rates, more people will seek to buy and/or simply not move, for now.

BTH: What do you expect come fall 2025 for those who might be thinking of making an investment or leveraging one?

RC: Over the last decade of enduring every imaginable obstacle, from the 2019 Rental Law to the pandemic to the doubling of interest rates, pricing has remained relatively flat. This, for me, defines a bottom. We are still in the early stages of a significant generational wealth transfer, which sets the stage for a multiple-year run of escalating prices. Tight inventory, growing acceptance of the current market dynamics and the eventual easing of rates will create intense competition. Buying now will be far more affordable than buying in one, three, or five years from now.

Email tvecsey@danspapers.com with further comments, questions or tips. Follow Behind The Hedges on X and Instagram.