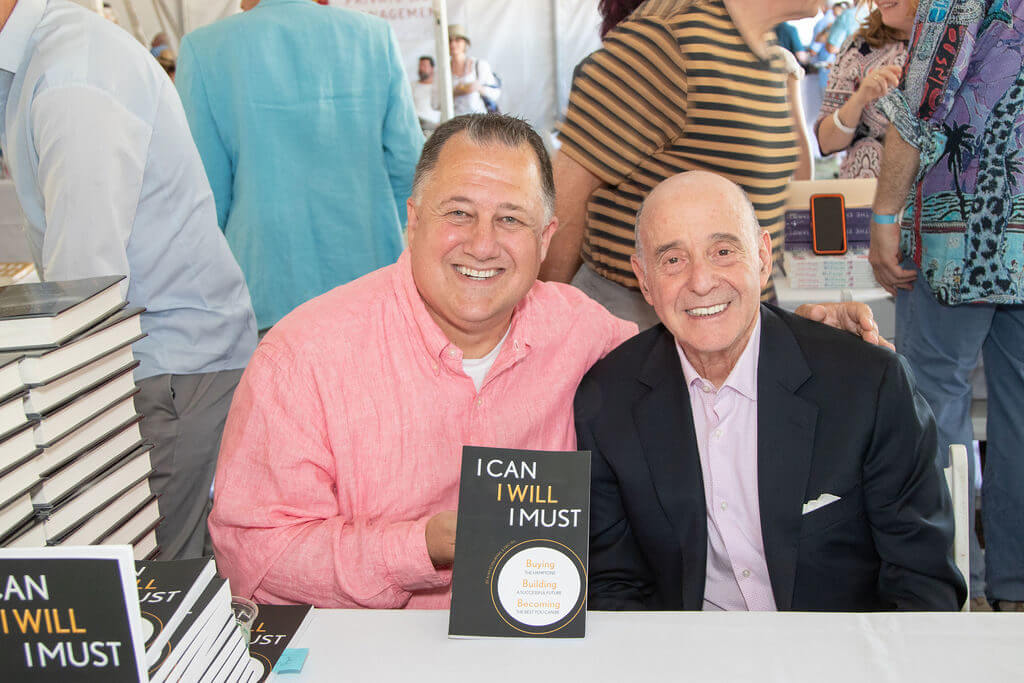

When Saunders & Associates broker and real estate guru Alan Schnurman and Dan’s Hamptons Media President and Editorial Director Eric Feil got together to write I Can, I Will, I Must: Buying the Hamptons, Building a Successful Future, Becoming the Best You Can Be, an essential question was posed to Schnurman: “Why Real Estate?” As they explored how the lessons, traits and practices that underpin a successful real-estate investing strategy are the same as those for a successful life strategy, the answer became clear…and the title of Chapter Two:

You can invest in anything. Throughout history, there’s been no asset, no idea, that hasn’t been able to seduce people to hand over their money to someone else with the hope of making it grow. Treasury bonds or Beanie Babies, rare coins or cryptocurrency, fine art or a fledgling singer’s career. Domain names, bull semen, gold Krugerrands, parking spaces–there’s a market for everything and people have stocked up on it all. And, let’s not forget, there’s the good old stock market. But none of it comes close in scale to one market that stands on its own.

Real estate, quite simply, is the largest financial market in the world. You could add all the stocks, all the bonds, every collateral debt obligation, and it doesn’t equal real estate. And investing in real estate, at least the way I do it, plays to particular personality traits. Granted, some of these are innate. Others, however, can be learned.

When I was younger, I would invest in the stock market. When a stock would double, I would sell it, and then it would go up tenfold. And when a stock would go down, I would still have it, gathering dust in the closet. So I knew the stock market wasn’t for me. But I’ve never lost money in real estate. Not one dime.

I’ve invested millions of dollars in real estate since the 1970s. I’ve seen mortgage rates in double digits and inflation at nearly 14%. I’ve seen the housing bubble take prices to unheard of levels and then watched the entire bubble burst at the start of the Great Recession. Olympic boycotts and big bank bailouts, the fall of the Berlin Wall and the birth of the internet. Seven presidents have sat in the Oval Office while I’ve invested in real estate. Through it all, real estate has made me money.

You want more?

•Real estate is, by its very definition, real. You can touch and feel it. It’s not some amorphous share of a company in some part of the world you’ll never visit, not some enterprise that exists in the cloud without anything truly tangible.

•You can invest in real estate while you have another career. Or more than one other career. Remember, I’ve been a lawyer, a TV personality, an internet pioneer, a public speaker…and all that time, I was building my real estate portfolio. When I was a lawyer, I didn’t need the income from real estate, but I invested in real estate over a long-term basis. Things I bought 35 years ago, I still have.

•You can use your real estate to generate income. My partners and I have numerous commercial rentals that have kept cash flowing for decades–all the while appreciating in value–residential properties, retail properties, skyscraper office buildings and land with nothing yet built upon it.

There are so many aspects to real estate: the guy who buys the land, the guy who builds the house. I try to diversify, so when my retail is soft, my residential is good. When they’re both down, hopefully my land deals are going well, or the office market is going well.

•Real estate is a strong weapon in battling taxes and inflation. The laws change over time here and there, but taxes, interest, depreciation, maintenance and other financial factors should be taken into account when you’re weighing the advantages of investing in real estate.

•Real estate does not suffer the daily volatility of the stock market, where ups and downs are reported and obsessed over on a minute-by-minute–or faster, now–basis. Do you really want to be investing in antacids because of your stock investments?

•There’s never a bad time to start investing in real estate. When the economy is soaring, it’s a fine time to get in. When the economy is sinking, it’s a fine time to get in. People always need places to live, office space to house their companies, storefronts from which to run a small business, land on which to build a mansion. Regardless of whether they want to buy or rent, if you own it, these people need what you have. There’s a demand for what you can supply.

•You’re the master of your own destiny. When you buy stock in a company, you’re now at the whim of the company’s management, its workers, even its customers. When you create your own real estate deals, you’re in charge of everything.

•Good-location real estate always, in the long term. grows in value. Always. It’s that simple. There are no guarantees in life, but that’s about as close as you can come. It won’t happen overnight (although every now and then…), but over time, it makes you money.

By 2017, 31 of the top 50 metro areas in the United States saw median home sales prices get back above pre-Great Recession levels. Yes, that took almost a decade, but you can also think of it as, Wow, even in the worst financial situation our country has faced since the 1930s, real estate came back. And remember, that number is derived from a range of markets, good and not so good. When you invest in the best locations, that recovery is faster and stronger than anywhere else.

•You don’t have to be a genius to invest in real estate. You just have to be patient. It’s a slow, reliable, methodical investment vehicle. It’s the easiest route to financial security that I have ever seen.

Alan Schnurman and Eric Feil will be speaking and signing copies of “I Can, I Will, I Must” at John Jermain Library in Sag Harbor from 3-4:30 p.m. on Sunday, December 1. For more information, visit johnjermain.com.