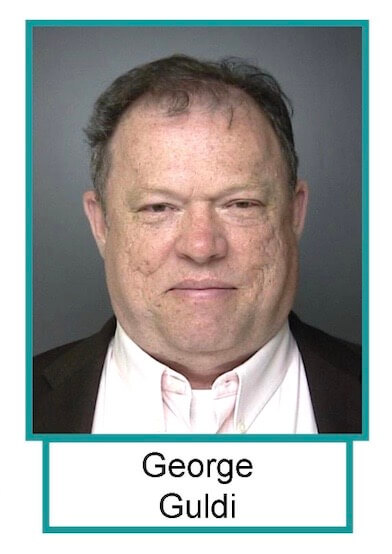

If it’s a story that sounds eerily familiar — that’s because it is. Former Suffolk County legislator George Guldi has been convicted of fraud.

While serving time in Marcy Correctional Facility, Guldi defrauded a mortgage lender out of more than a quarter of a million dollars with the help of his former girlfriend, according to Damian Williams, the United States Attorney for the Southern District of New York.

“George Guldi, while in prison, concocted and conducted a scheme along with his co-conspirator, Victoria Davidson, to brazenly steal more than $250,000 through blatant lies,” Williams said in a statement on Wednesday, January 25, following a two-week trial in a Manhattan federal courtroom.

Now a Ludlow, Vermont, resident, Guldi had been serving time following several fraud convictions. In March 2009, Guldi, who was out of politics at the time and had a real estate practice in Westhampton Beach, was charged, along with three others in an $82 million mortgage fraud scheme. Not long after, he was separately charged with insurance fraud, accused of pocketing an insurance check meant to go into an escrow account to rebuild his Westhampton home that was destroyed by a fire. During one prison stint in 2011, he even reportedly wrote a letter to Dan’s Papers, about life in prison.

Guldi will soon be upgrading to a federal prison cell. He faces as many as 50 years.

“Today, a jury held them accountable for their scheme, and they will both face justice for their shameless misconduct,” Williams said.

According to court filings, this latest crime began in February 2017 when Ditech Financial LLC, the mortgage lender, received approximately $250,000 from JPMorgan Chase in connection with the settlement of a civil lawsuit between several financial institutions.

“Ditech mistakenly treated the funds as a payment from Guldi toward his own mortgage, and it sent a letter to Guldi in March 2017 stating that it would not credit the payment because he owed more than the payment,” according to the statement from Williams.

Guldi, then behind bars, instructed his former girlfriend to contact Ditech to “break” the funds “loose,” as he put it in a recorded call from prison, the statement from the United States Attorney’s office said.

Davidson called Ditech at least 19 times telling “multiple lies in an attempt to obtain the funds,” including that she was an attorney and officer of Guldi’s company. She said that Guldi sent the money “accidentally” and wanted them returned.

Ditech wired the funds to Davidson’s bank account. Davidson spent the money fast, paying expenses for her and Guldi. She used the money to pay thousands of dollars in property taxes for properties in Vermont, and, according to Newsday, to make child support payments, to pay parking tickets and even to go to a spa and the Whitney Museum.

“Within months, the money was gone,” Williams said.

The jury found Guldi, who is now 69, and Davidson, a 57-year-old resident of Lakeville, Connecticut, guilty of one count of conspiracy to commit wire fraud and bank fraud, one count of wire fraud, and one count of bank fraud.

They are facing 30 years in prison on the conspiracy and bank fraud counts and 20 years on the wire fraud count.

Guldi remains free on bond. Sentencing is scheduled for May 31, 2023, before U.S. District Judge Alvin K. Hellerstein.

Guldi, a Democrat, represented the South Fork as a legislator from 1994 to 2003, when he was ousted from the position by Jay Schneiderman.

Guldi’s attorney, Ian Marcus Amelkin, did not immediately return a request for comment.

Email tvecsey@danspapers.com with further comments, questions or tips. Follow Behind The Hedges on Twitter, Instagram and Facebook.