A restaurateur and developer has officially purchased two major pieces of Sag Harbor real estate, a shopping complex along the waterfront and Main Street that had been eyed for the future home of the Bay Street Theater.

We’re told the deal closed on Tuesday, February 11, for $30 million. Hal Zwick and Jeffery Sztorc of Hamptons Commercial Real Estate at Compass represented both sides.

Jeremy Morton of Excelsior Development, a Hamptons-based developer, had already begun his planning process with the village late last year, which includes an extensive renovation and adding a second floor to both buildings.

“The Sag Harbor properties represent one of the rare waterfront retail complexes in the Hamptons. We look forward to the renovated property and the new businesses’ contributing to the business district,” says Zwick.

Morton received a $40 million first mortgage loan from Mavik Capital Management for the acquisition and redevelopment of the retail property at 22 Long Island Avenue and 2 Main Street, according to a source familiar with the deal. He has made substantial commercial real estate purchases before, including Ruschmeyer’s and Rick’s Crabby Cowboy Café in Montauk in 2020 and 2021 respectively and the since-sold Morty’s Oyster Stand on the Napeague Stretch.

The Properties’ Prime Location

The two commercial properties were listed together for the first time in June of 2024 exclusively with Zwick and Sztorc. While no asking price was made public, the asking price was likely over $30 million, Behind The Hedges reported last year.

In January 2023, the Friends of Bay Street put 22 Long Island Avenue up for sale at $25 million, two years after the group purchased it intending to build a new home for Bay Street Theater. Multiple theaters had been envisioned for the property, including a main stage, a center for new work development, shop and scenery storage, outdoor performance and public spaces.

“We have thoroughly examined the site and have determined this property is no longer viable to build a theater as originally envisioned,” Adam Potter, the chairman of Friends of Bay Street, said at the time.

The nonprofit board purchased the property for $13,091,030 in October 2020. Douglas Elliman’s Enzo Morabito and Adam Rothman represented the property when it went on the market the previous July for $13.9 million.

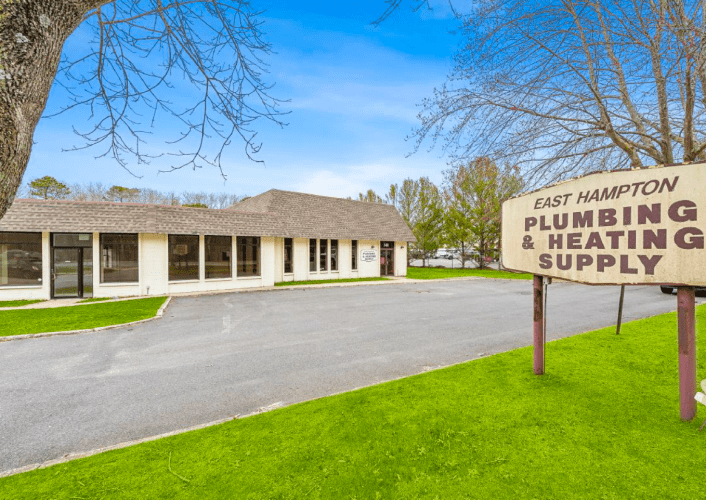

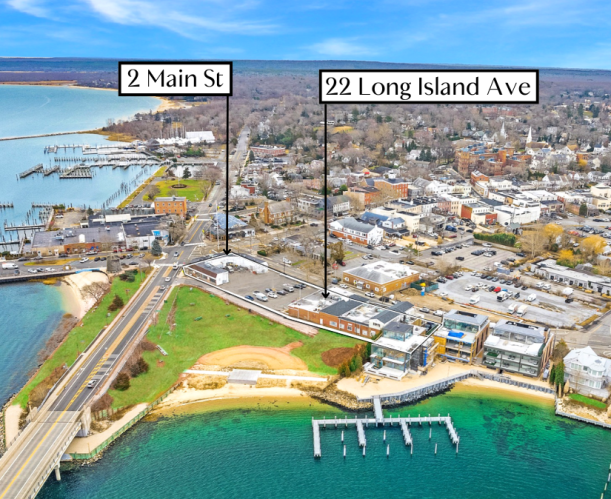

With plans abandoned for the theater, what remains is a 15,000-square-foot, mixed-use building that sits on a 0.67-acre parcel overlooking Sag Harbor Cove and John Steinbeck Waterfront Park.

There are 12 units in the building, ranging from a 290-square-foot architectural office to a 3,075-square-foot retail grocery store (formerly 7-Eleven, which left after the property changed hands). Part of the building that fronts on West Water Street is two stories. The property is just 400 feet from Main Street with a parking lot for 26 vehicles dividing it from the adjacent property.

The adjacent property at the foot of Main Street last traded in 2021, when it sold for $18 million, purchased by an entity tied to the non-profit Friends of Bay Street.

Known to locals as Fort Apache from when it was vacant land, the 0.27-acre property holds one of the most visible buildings on Main Street. The horseshoe-shaped building at 2 Main Street fronts on Main Street and Long Island Avenue, as well as it has an easement along the beginning of the John Steinbeck Park with the foot of the bridge to North Haven just beyond. It is currently home to K Pasa (formerly La Superica), Espresso’s, Yummylicious and the UPS Store. The 4,600-square-foot building can hold four tenants with spaces ranging from 800 to 2,000 square feet.

The building features a parking lot behind it, which backs up to the parking lot for the property at 22 Long Island Avenue, a 0.67-acre property that offers 300 feet of frontage on West Water Street and panoramic water views.

Both properties are a stone’s throw from a high-end residential waterfront development, designed by the award-winning Andre Kikoski Architect.

Big Loan From Mavik

Morton’s planning for a major renovation is “to reposition the properties and bring rents in line with the area’s strong market demand,” the source says.

“Mavik’s financing provided Excelsior with a one-stop, full-stack solution, eliminating the need for a separate mezzanine or preferred equity component, an approach that would have increased execution risk,” says the source.

A New York-based investment firm, Mavik describes itself as “a next-generation, multi-strategy investment firm built to deliver long-term outperformance. Founded by Vik Uppal, the company focuses on commercial real estate credit and special situations.

We’re told that Morton initially asked for a mezzanine or preferred equity piece, but that Mavik instead structured a comprehensive, single-source financing package that gave the borrower the flexibility needed to execute its business plan successfully.

Though Mavik usually concentrated on the metropolitan area and Connecticut, Sag Harbor has certainly become a highly sought-after real estate market. The village boasts low commercial vacancy rates of less than 3% and growing demand, all in a small footprint near the water, which makes the real estate extremely valuable.

The firm has held $1 billion in assets under management since September 2022. According to a 2023 article in Private Investor Debt, Mavik is backed by global investment giant Blackstone, which holds a 20% piece of the firm.

Other recent deals that Mavik closed include a $130 million preferred equity investment for a luxury multifamily property in New Haven, Connecticut, a $107 million mezzanine loan to complete the construction of and lease a multifamily property in Long Island City and a $25.1 million first mortgage for a hotel-to-multifamily conversion in Syracuse, New York.

Email tvecsey@danspapers.com with further comments, questions or tips. Follow Behind The Hedges on X and Instagram.